It has been several years in the making, but Japan is finally returning to nuclear power.

Although Japan won’t turn its reactors back on en masse, the Sendai nuclear power plant owned by Kyushu Electric Power is set to come back online this week, the first reactor to do so in years. Kyushu expects to switch back on a second reactor in October. And in 2016, 11 more units could be restored, marking a significant, if incomplete, return to nuclear power.

Due to new safety regulations, a tangle of legal challenges, and strong public opposition, the timing of Japan’s return to nuclear power has been unclear, although widely anticipated.

The government of Prime Minister Shinzo Abe has pushed back against public protest to support nuclear restarts, and it is not hard to see why. Japan has historically run large trade surpluses, but its trade balance quickly turned negative after the shutdown of its entire nuclear fleet following the Fukushima meltdown. Last year, the trade deficit hit a record $103 billion.

Related: The Saudi Oil Price War Is Backfiring

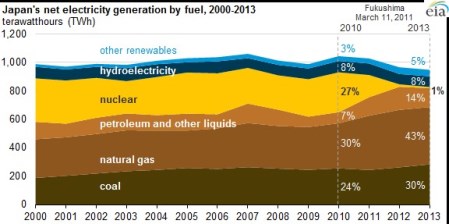

That is because without the electricity generated from Japan’s 43 nuclear reactors, the nation has resorted to expensive imported sources of fuel, such as coal, natural gas, and oil. The large increase in fossil fuel imports led to a surge in the price of LNG cargoes, and contributed to higher demand for coal and oil as well.

So, with nuclear power on the way back, these trends could be reversed. What does that mean for commodities like coal, natural gas, and oil?

Nuclear restarts will put downward pressure on spot LNG prices. The Platt’s Japan-Korea Marker (JKM), a benchmark for LNG in East Asia, often traded below $10 per million Btu (MMBtu) in 2010, the year before the Fukushima disaster. But in the years following the closure of Japan’s nuclear reactors, prices spiked, reaching an all-time high of $20.20 in March 2014.

Related: The Price Of ‘C’ In China

Prices have collapsed since then as new supplies have come online, most notably in Australia. Also, since LNG prices are largely linked to the price of oil, the oil bust over the past year has led to a corresponding crash in LNG prices. According to Platts, front month JKM cargoes for September 2015 are now trading at $7.825/MMBtu, or less than half of what they were just a year and a half ago.

But the Sendai plant represents a new threat to LNG prices. Japan is the largest LNG importer in the world, accounting for more than a third of the total LNG trade worldwide. With the restart of the Sendai plant, and with almost a dozen additional reactors not too far behind, Japan’s LNG consumption could drop. That would be hugely negative for LNG prices, already reeling from an oversupplied market.

No doubt LNG exporters around the world are watching these developments closely, especially those that have not already secured long-term contracts at fixed prices. Even for the LNG suppliers that have lined up customers, many have not secured 100 percent of their export capacity for sale, leaving a certain fraction left over for the spot market.

In short, Japan’s perseverance to restart its nuclear reactors could cut into (current and future) profits for LNG exporters in Australia, Qatar, the U.S., Canada, or any other place that has or is considering LNG export terminals.

Related: Midweek Sector Update: Have We Reached A Bottom For Oil Prices?

The negative price pressure is also true for oil, although to a lesser extent. Japan uses oil in some of its power plants, a source of electricity that doubled its market share from 7 to 14 percent following in the aftermath of Fukushima. More nuclear will cut that share back down, and as the third largest oil importer after China and the U.S., lower oil imports will put downward pressure on oil prices, already tanking in an oversupplied market. The effect won’t be as large as it will be for LNG not just because Japan uses comparatively less oil for electricity, but also because oil markets are much more global and fluid, whereas LNG has fewer players and more rigid pricing.

For coal, the story is the same. International coal prices have plummeted amid a supply glut and tapering demand, and more nuclear power will leave extra coal supplies on the market.

The crash in commodity prices continues to deepen, and Japan’s return to nuclear power will remove even more demand from the market.