Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

Pre-Open market analysis

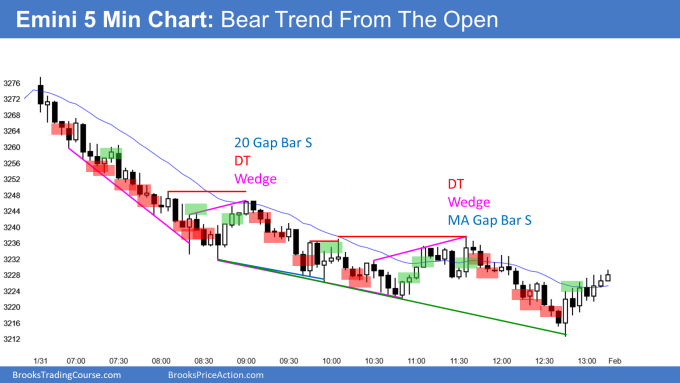

The Emini sold off strongly on Friday after Thursday’s strong rally. January closed near its low. It is a sell signal bar on the monthly chart. The sell signal will probably trigger early this week.

However, it followed 4 bull bars closing near their highs on the monthly chart. This is, therefore, a weak sell setup. The best the bears will probably get is a 1 – 2 bar pullback. Since that is the monthly chart, the pullback will probably last a few weeks to maybe a couple months.

I wrote a few weeks ago that the minimum goal for the bears was 5%. Nothing has changed. What is unknown is the path. Because of the strong 4 month rally, there will be bulls buying every selloff. Therefore, if the Emini continues down, it will probably have a lot of trading range price action along the way.

Today is the follow-through bar after Friday’s big bear breakout. The bears want a bear bar. That would increase the chance of lower prices. The bulls want a strong reversal up today. They want Friday to be a bear trap. The odds still favor lower prices even if the bulls get a bounce this week.

Because Friday was a sell climax, there will probably be at least a couple hours of sideways to up trading today that begins by the end of the 2nd hour. Because Friday was so extreme, there is an increased chance that today will be a trading range day.

Overnight Emini Globex trading

Friday’s setups

Here are several reasonable stop entry setups from Friday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.