It’s called the Forex January Effect — and it is a powerful driver of the U.S. Dollar and Eurocurrency

There is an extremely powerful tendency for the U.S. Dollar Index to experience its annual high or low in January. The same (but opposite) is true for the euro currency.

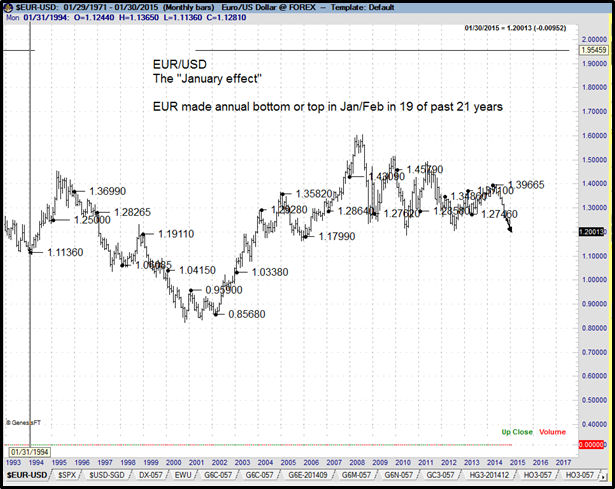

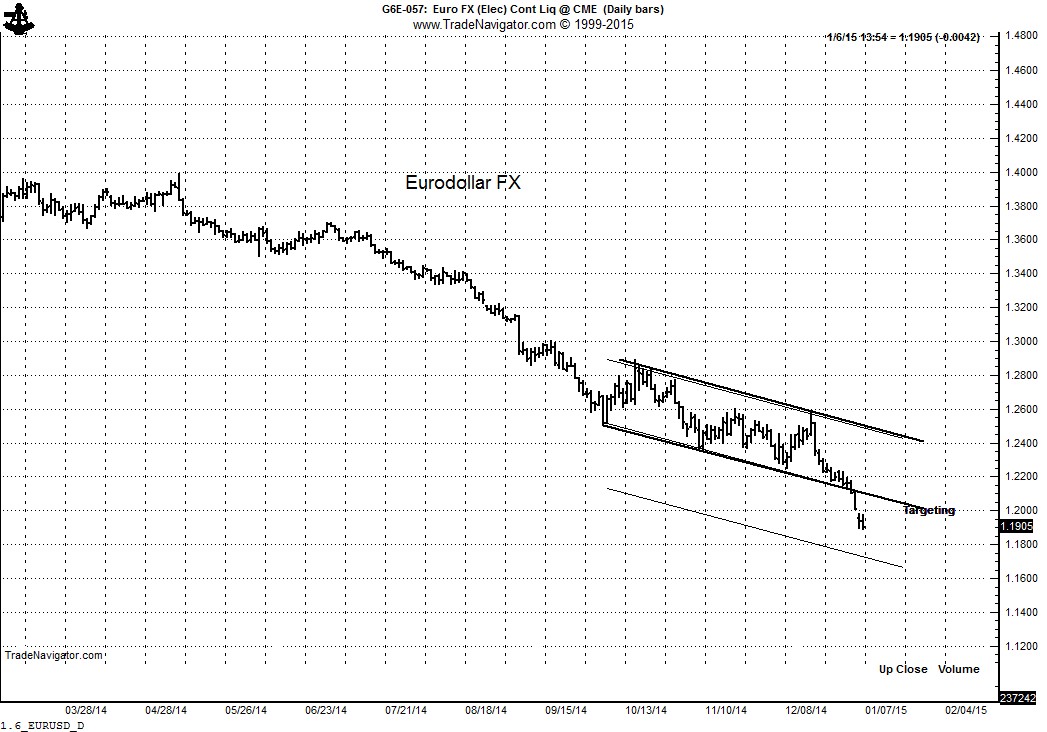

In fact, in 20 of the past 21 years the euro FX has topped or bottomed in January. In four of these 20 years the January high or low was part of topping or bottoming phase that was not resolved until February or March. The table and chart below tell the story:

Will the low or high for the euro in 2015 be registered in January? Only time will tell. Yet, a technical case can be made for a decline in the euro — and this would set up the possibility of a January high in 2015.

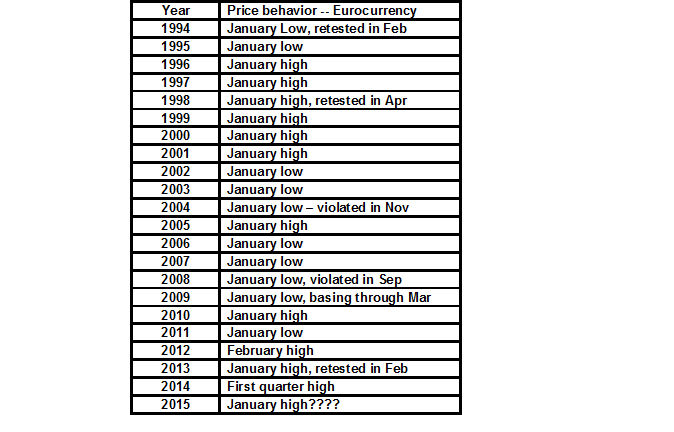

The decline to-date in January is attempting to complete a massive 5-year descending triangle on the monthly chart. A decisive decline below the 2010 low would seal this case and establish targets as low as $.91xx.

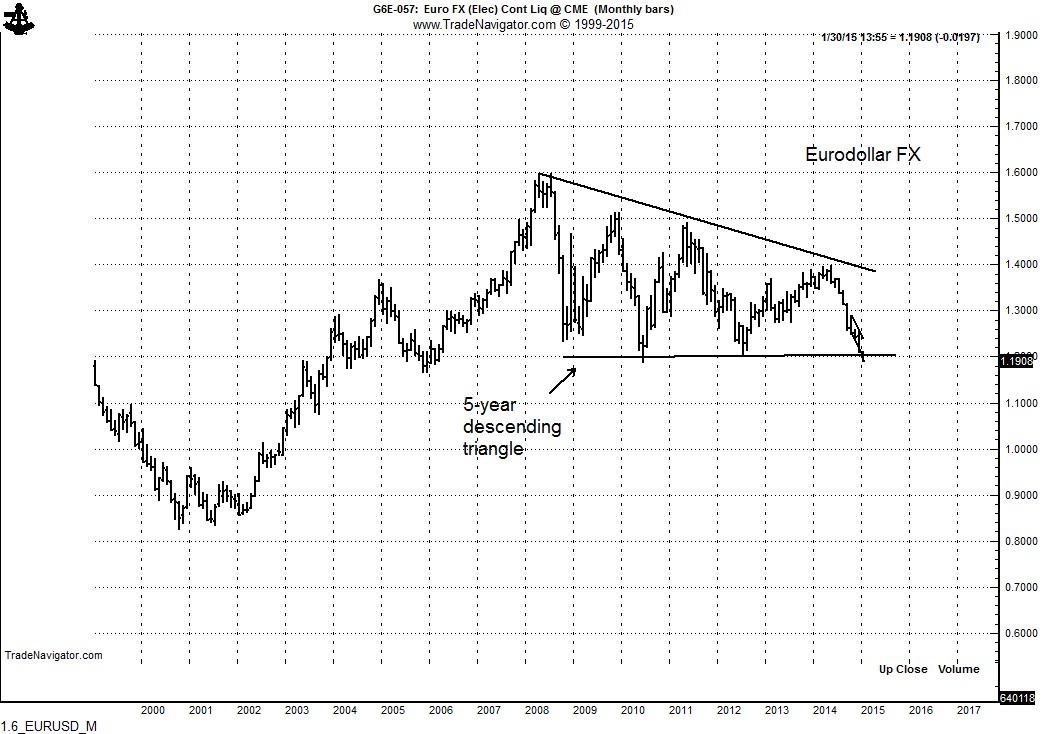

The recent decline on the daily chart penetrated the lower boundary of a channel. Such a penetration often is a sign of the acceleration of a move.

Disclaimer: I am short the eurocurrency, long the USD/SGD, short peso futures and long U.S. Dollar Index. In other words, I am talking my position.

I trade futures, forex and stocks on the basis of classical chart patterns. I believe that price geometry is an indication of the power of the supply and demand forces in the markets. I pay little attention to technical indicators and no attention to the type of fundamental or macro analysis nonsense spouted by the pretty faces on CNBC. My goal is to identify the 10 to 20 best chart patterns in the forex and futures markets each year. I also periodically will trade patterns in stocks.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.