Asian markets advanced moderately on Tuesday. The Kospi climbed .8% to 1956, the Hang Seng rallied 1.1%, and the Shanghai Composite added .3% to 2293. Lagging behind, the Nikkei inched up .1% to 8803, while the ASX 200 slipped .2%.

European markets gained as well, despite weaker than expected data from the US. The CAC40 posted a solid 1% gain, while the DAX and FTSE rose a modest .2%. Hopes lingered on for a Greek debt deal, while pressure mounted on the heavily-indebted country to undertake steep spending cuts.

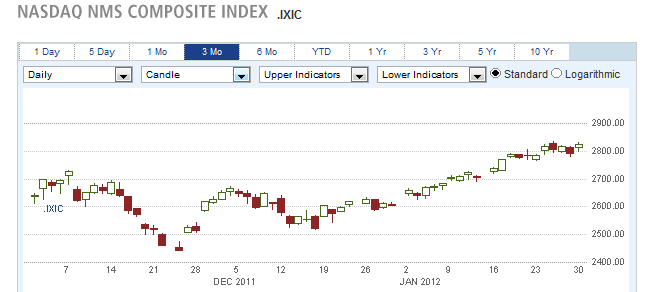

US stocks closed little changed, overcoming earlier losses. The Dow slipped 21 points to 12634, the S&P 500 closed flat at 1312, and the Nasdaq gained 2 points to 2814. Nonetheless, January was an extremely strong month for stocks, as the Dow climbed 3.4%, the S&P 500 advanced 4.4%, and the Nasdaq soared 8%.

Nasdaq Soars 8% in January

RadioShack tumbled 30% after issuing a profit warning, dropping to a 3-year low. Mattel advanced 5% on strong earnings, while UPS slipped .7% despite exceeding analyst forecasts.

Currencies

The Dollar was mixed as US growth concerns weighed against European debt troubles. The Euro ticked down .4% to 1.3080, and the Swiss Franc shed .3% to 1.0864. The Pound and Australian Dollar both gained .3% to 1.5760 and 1.0617 respectively, and the Yen rose .2% to 76.22.

Economic Outlook

Tuesday’s sobering economic data reawakened doubts over the pace of the US economic recovery. The Case Shiller home price index fell by 3.7%, significantly worse than last month’s 3.4% drop. Chicago PMI dropped to 60.2 from 62.5. Consumer confidence slumped to 61.1 from 64.8, whereas analysts had expected an increase to 68.2.

Western Stocks Rally, Boosted by Positive Data

Equities

Asian markets ended mixed after conflicting data from China failed to provide direction. The official PMI data pointed to an expansion in manufacturing, while HSBC PMI data indicated a mild contraction. The Shanghai Composites slumped 1.1%, the ASX 200 dropped .9%, and the Hang Seng dipped .3%. Amongst the gainers, the Nikkei inched up .1%, and the Kospi edged up .2%. Korean builders soared, as Samsung Engineering and Hyuandai Engineering both gained nearly 5%.

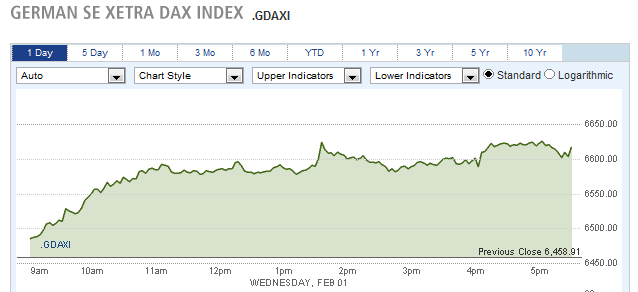

European markets rallied strongly, supported by upbeat economic news from Germany and the US. The DAX surged 2.4%, the CAC40 climbed 2.1%, and the FTSE jumped 1.9%. Banking shares rebounded 3.8% on news a Greek debt deal was imminent.

DAX Rallies 2.4% on Strong German Manufacturing Data

US stocks climbed as well. The Nasdaq outperformed, closing up 1.2%, followed by the S&P 500, which rose .9% to 1324. The Dow rose 84 points to 12716, ending its 4-day slide.

Amazon shares tumbled 7.7% after the company reported a sharp drop in revenue, and lowered its outlook. Whirlpool shares surged 13.5% after issuing a strong outlook, and Broadcom jumped 8.1% after beating analyst profit forecasts.

Currencies

The Dollar settled modestly lower against global currencies. The Euro rose .5% to 1.3156, recovering from an earlier drop down to 1.3028. The Australian Dollar settled up .7% to 1.0698, while the Pound and Swiss Franc advanced .4%. The Canadian Dollar broke through the parity level, gaining .3% to .9988, and the Yen inched up .1% to 76.22.

Economic Outlook

Wednesday’s ADP Employment report showed the economy gained 170K jobs last month, falling short of expectations of 189K, but still a very respectable figure. The official government non-farm payroll report will be released on Friday.

Asia and Europe Rally, US Ends Mixed

Equities

Following the West’s lead on Wednesday, Asian markets rallied on Thursday. The Nikkei gained .8% to 8877, as financial stocks led the gains. Sharp tumbled 16% to a 31-year low after warning of a record loss for the upcoming year. The Kospi climbed 1.3%, as LG Electronics advanced 7.4%, posing its 9th straight gain. In China, the Hang Seng and the Shanghai Composite both soared 2%, while Australia’s ASX 200 advanced 1%.

European markets posted modest gains, led by materials stocks, which posted a gain of 2.7%. The DAX rose .6%, the CAC40 edged up .3%, and the FTSE ticked up .1%

Mining group, Xstrata, soared 9.9% after confirming it was involved in merger talks with commodity trader, Glencore. Glencore shares surged 6.9%.

US stocks ended mixed as traders prepared for Friday’s job report. The Dow slipped 11 points to 12705, the Nasdaq advanced .4%, and the S&P 500 edged up .1%.

Currencies

Currencies traded in narrow ranges, with the Dollar moving up slightly. The Euro and Swiss Franc both slipped .2% to 1.3149 and 1.0912 respectively, and the Pound lost .3% to 1.5807. The Yen and Australian Dollar closed flat.

Economic Outlook

Weekly jobless claims fell to 367K, 6K better than forecast. Labor costs rose more than expected, while productivity increased less than expected, both positive developments for the employment situation.

US Jobs Data Blows Past Forecasts, Stocks Rally

Equities

Asian markets traded mostly lower as weaker-than-expected data from China weighed on shares. The Nikkei declined .5% to 8832, while Sony shares surged 8.1% after the company announced a new CEO would take over. Korea’s Kospi slid .6%, and the ASX 200 eased .4%. Chinese markets gained, with the Shanghai Composite rising .5%, and the Hang Seng inching up .1%.

US payroll data blew past analyst estimates of 150k, with the economy gaining 243K jobs last month. The unemployment rate slipped to 8.3% from 8.5%. The good news pushed European markets higher in the afternoon. The FTSE jumped 1.8%, the DAX advanced 1.7%, and the CAC40 gained 1.5%.

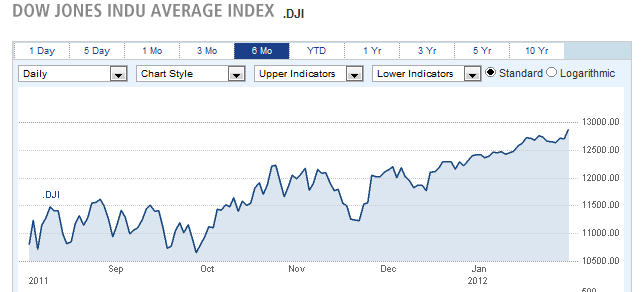

In the US stocks rallied, with the Dow closing up 157 points to 12862, its highest closing level since May 2008. The Nasdaq surged 1.6% to its highest level in a decade, and the S&P 500 climbed 1.5%. The VIX tumbled 4.9% to 17.10, a sign of increasing investor confidence.

Dow Rallies to 3.5 Year High

Gilead Sciences surged 11% after announcing promising results from its experimental hepatitis C treatment.

Currencies

Despite the strong economic data, the Dollar traded moderately lower on Friday, as traders moved back into risk-on mode. The Canadian Dollar led the gains, rising .6% to .9936, despite weaker than expected Canadian employment data. The Australian Dollar gained .5% to 1.0762, and the Euro ticked up .1% to 1.3160. Bucking the uptrend, the Yen fell .5% to 76.60, and the Swiss Franc eased .1% to 1.0896.

Economic Outlook

Aside from the strong jobs data, ISM non-manufacturing PMI advanced to 56.8, up from last month’s 52.6. Factory orders were slightly disappointing, rising only 1.1%, whereas economists had forecast a gain of 1.5%.

Overseas, UK services PMI hit a 10 month high, rising to 56 from last month’s 54 reading. Canada’s unemployment rate rose marginally to 7.6%, as the economy gained just 2.3K jobs, well below forecasts for a 23.3K gain.

Focus Shifts to Greece as Debt Deal Remains Elusive

Equities

Friday’s strong jobs data gave Asian markets an opening boost on Monday. The Nikkei and ASX 200 both climbed 1.1%, while the Kospi surrendered an early gain to end flat. China’s Shanghai Composite also closed flat, while the Hang Seng eased .2%.

European markets slipped slightly as anxiety overGreece’s debt troubles pulled down financials. The CAC40 fell .6% the FTSE eased .2% and the DAX ended flat as Greece policymakers struggled to reach an agreement with debt holders, even as the official deadline for a deal passed.

Back at home, US stocks opened lower but erased most of their losses as the session progresses. The Dow settled down 17 points to 12845, the Nasdaq dipped .1%, and the S&P 500 settled down fractionally at 1344.

Currencies

The Dollar had rallied earlier in the morning, but those gains evaporated as the day progressed. The Euro declined .1% to 1.3133, recovering from a low of 1.3031. The Pound rose .1% to 1.5828, the Australian Dollar edged up .2% to 1.0730, and the Canadian Dollar climbed .3% to .9960. The Yen fell .5% to 76.56, and the Swiss Franc slipped .2% to 1.0886.

Economic Outlook

Pressure is mounting on Greeceto secure a deal before time runs out, triggering a default. Greecehas until March 20th to make a payment of 14.5 billion euro, or it will default. A deal for a 130 billion euro bailout has been pending since October, awaiting concessions fromGreece.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

January Closes Quietly as Stocks Post Large Monthly Gains

Published 02/14/2012, 04:13 AM

Updated 05/14/2017, 06:45 AM

January Closes Quietly as Stocks Post Large Monthly Gains

Equities

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.