Three cheers – for the first time since 2013, the January Barometer is bullish. The January Barometer was devised by Yale Hirsch in the early 1970’s and is still tracked today at STA by his son Jeffrey Hirsch. The simple theory is that “as January goes, so goes the rest of the year”, if January shows a gain then the 11 months from end of January through the end of December should also show a gain.

(See also A Two-Fund Portfolio for the Next Three Months)

Using the Dow Jones Industrials Average, Figure 1 displays the growth of $1,000 invested in the Dow from the end of January through the end of December only during those years when the Dow Industrials showed a gain during the month of January.

Figure 1 – Growth of $1,000 invested in the Dow Jones Industrials Average ONLY between end of January and end of December if January shows a gain.

For the record, since 1943 following a gain for the Dow Industrials during January, February through December shows:

- # times up = 40 (85% of the time)

- # times down = 7 (15% of the time)

- Average Gain = +13.2%

- Average Loss = (-8.4%)

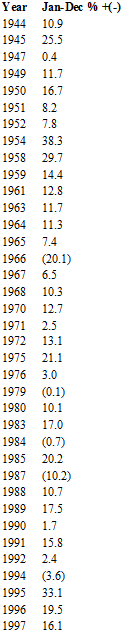

The year-by-year results appear in Figure 2:

Figure 2 – Year-by-Year Dow % +(-) following an UP January (price data only, NOT total return).

How to Use AND How NOT To Use This Information

The proper way to use this information is as “weight of the evidence” – i.e., as a reminder to be patient in giving the bullish case the benefit of the doubt between now and December 31st, 2017.

The improper way to use this information is to assume that things are “All Clear” between now and the end of the year and that you can simply forget all about your stock market investments, because there can be countervailing influences.