Up until last week most market pundits were pointing to an increasingly hawkish Federal Reserve as being indicative of a confirmed June rate hike. However, the latest US Non-Farm Payrolls result proved highly negative, coming in just at 30k and likely sinking any chance of a change to the FFR in the next month.

However, despite the torrid labour market result and subsequent bearishness evident in the markets, the Fed still wheeled out Chairperson Janet Yellen to stoke the fires of discontent. Subsequently, the venerable central banker provided an artful display of tightrope walking as she suggested that a gradual increase in rates was still on the cards whilst also advocating that the current monetary policy regime is generally appropriate.

Unfortunately, public relations training might have helped the banker to moderate her tone but it did little to appease those of us that understand that you literally can’t have it both ways. Subsequently, unless Yellen pulls a David Copperfield, she will need to either choose between an accommodative monetary policy and a hike to the Federal Funds Rate.

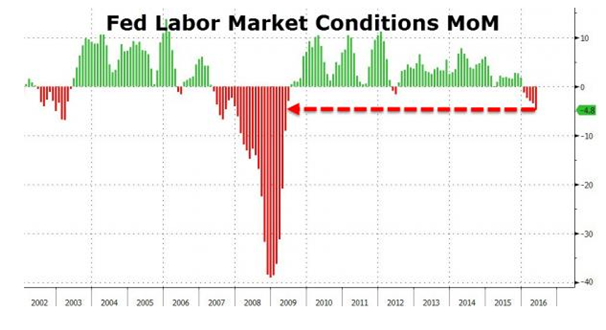

It is clear from the largely schizophrenic speech that the Fed Chair is hoping that the dismal 30k print is an anomaly or aberration. However, there have been some concerning signs within the broader US economy which suggest that the depressed job number may be a harbinger of things to come. In fact, the latest Fed Labour Market Conditions index shows just how bad the descent has been, with the key metric contracting at the fastest pace in over 7 years.

Subsequently, Janet Yellen and the central bank now both face a crisis of credibility as the recent ministrations of the FOMC members largely positioned the market for a June rate hike. As recently as two weeks ago, a bevy of members were using the expectations channel to hammer home the increased risk of a rate hike.

In fact, Bloomberg had the expectation rate at over 30% for a hike in June. So it makes little sense that in such a short period of time we are now back to the “Will They, Won’t They” argument. In addition, it speaks volumes as to the real state of the US economy if a single jobs number can throw the chance of rate normalisation into such disarray.

The reality is that the central bank is caught between a quandary of monetary policy failures with potentially lacklustre global growth whilst at the same time the need to normalise monetary policy given some concerning signs within the credit and equity sectors. However, besides the risk to the economy, there is also a growing risk that the Fed’s credibility is all but used up. This is especially salient given there overwhelmingly whipsawing expectation setting.

It therefore has become apparent that whatever is going on with the venerable central bank has departed from the realms of monetary reality and your guess is as good as mine as to which macroeconomic data points they are attempting to satisfy before hiking rates. However, clearly it isn’t only the labour market, as that data has been solely strong enough to support a rise for some time now.

Ultimately, I suspect the Fed is concerned with the potential unravelling of equities once they embark upon the path of consistent monetary tightening. This is especially salient given that they are largely the chief architects of the largest equity bubble in the history of the US, of which a rapid popping could be disastrous.

Subsequently, given the above, I highly doubt June will elicit a rate hike. Nor will there be one for the rest of the 2016 if the labour market continues to slide.