Sell the rumour, and buy the news! The rumour was a possible IMF decision to include the yuan as a component of its SDR.

The news is out, and the news is good; the IMF has decided to include the yuan in its SDR virtual currency basket.

Donald Trump and other “protectionists” have argued that the yuan is undervalued against the dollar. In contrast, I’ve argued that it is overvalued, and with the IMF decision out of the way, the PBOC will likely cease its short term support.

That means the yuan should quickly begin a modest decline against the dollar, and that should produce a noticeable increase in Chinese citizen demand for gold.

Chinese New Year celebrations are also coming soon, and gold buying tends to accelerate significantly during that time. In addition, the Chinese stock market has sold off recently, while gold has been reasonably stable. With a potential decline in the yuan ahead, gold demand in China is poised for a hefty boost!

In the West, a number of factors are appearing that should also be supportive for the price of gold. The next US jobs report is scheduled for release on Friday. Gold often stages significant rallies in the days and weeks following the release of that report.

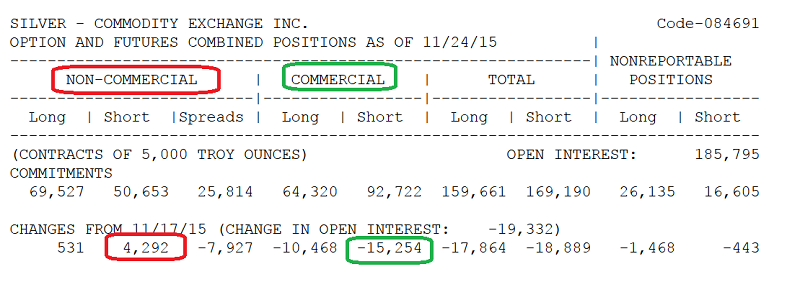

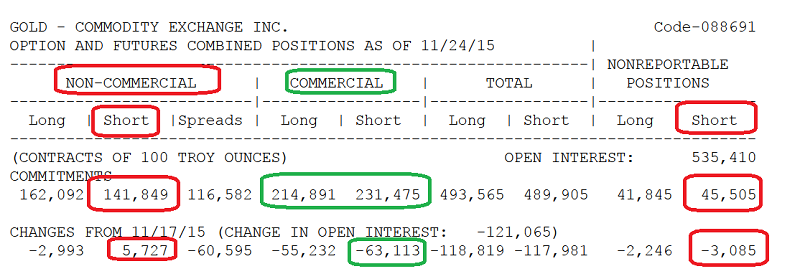

Also, the latest COT reports were released Monday, and I like what I see there. While the banks reduced both their longs and shorts (probably due to December futures expiry approaching) there is a net reduction of bank short positions, and that tends to happen in advance of nice price rallies.

Small investors (non-reportable positions in the report) are now net short gold. These “dumb money” investors tend to use a lot of leverage, and bet against the smart money banks.

The banks reduced their net short position, and that’s only modestly larger than their long position now. That’s very good news. The funds added more short positions into the latest decline, which is not a wise decision, given that the banks are reducing theirs.

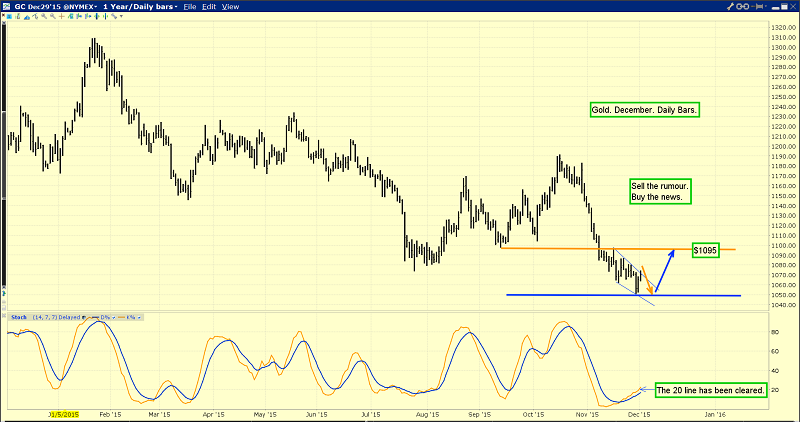

That’s the daily gold chart. There could a bit of a scary pullback to retest the $1050 area lows ahead of the jobs report, and gold is likely to remain rangebound in the $1050- $1095 area, until the FOMC decision on December 16th. The lead line on my key 14,7,7 Stochastics series oscillator, which I call “Tony the Tiger”, has moved above the 20 line, which is definitely good news.

Regardless, while gold may rise a bit or fall a bit over the next two weeks, it’s very important that gold investors think hard about the upcoming FOMC decision. Here’s why:

Western investors became a key force of demand, when the Fed initiated its QE program. They believed it would spur significant inflation. They were wrong.

They were wrong because while QE reduced overall interest rates, the Fed agreed to pay commercial banks interest on their reserves, at a higher rate than the Fed Funds rate. That single policy turned QE into a horrific deflationary fireball. Instead of reversing money velocity, the Fed caused it to implode.

The December 16th FOMC decision is critical for gold, because the Fed may decide to raise the Fed Funds rate, while keeping the ERR (excess reserves rate) static. If that happens, the banks will remove money from the Fed, and begin loaning it to each other, creating a new bull market in money velocity.

That’s the daily Global X Gold Explorers (N:GLDX) chart, above. It’s an ETF for gold exploration stocks.The volume is very bullish, and a significant rally appears to be imminent.

There is a massive bullish non-confirmation in play now between gold bullion and gold stocks. In November, gold bullion significantly penetrated the July lows, while silver barely did.

Most importantly, while bullion makes new lows, many gold stocks are trading far above theirs! Above is the chart for NYSE-traded Seabridge Gold Inc. (N:SA), and while bullion languishes, it’s one of many gold stocks displaying fabulous price and volume action.

In my professional opinion, the Western gold community is on the cusp of a watershed reversal in money velocity, and it will be unleashed by Janet Yellen on December 16th.

Goldman’s top economists predicts four very modest rate hikes over the next year. For the first time in history, because of the ERR/Fed Funds spread, rate hikes are bullish for gold. QE could have worked, should have worked, and would have worked, to reflate America, if Ben Bernanke had not incentivized the banks to hold reserves with the Fed. Ben probably should have been fired for incompetence, but that’s all water under the bridge now.

On December 16th, Janet Yellen is set to reverse Ben’s destructive policy, and usher in a new era for money velocity, gold stocks, silver, and gold.

Disclaimers: The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line: Are You Prepared?

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI