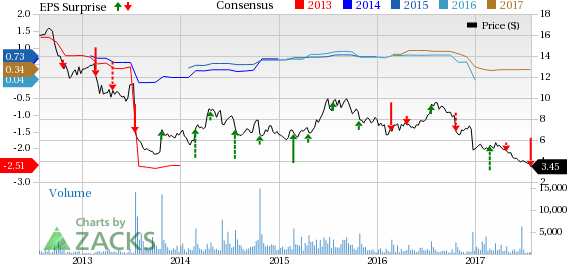

Shares of JAKKS Pacific, Inc. (NASDAQ:JAKK) fell 8% in yesterday’s trading session after the company reported wider-than-expected loss in the second quarter of 2017. Sales were also lower than expected in the quarter.

This California-based company’s loss of 66 cents per share was much wider compared to the prior-year quarter loss of 27 cents and the Zacks Consensus Estimate of a loss of 24 cents.

JAKKS Pacific’s revenues declined 15.2% year over year to $119.6 million owing to the company’s suspension of sales to one of its retail customers and decrease in several of its film-related licensed properties. Revenues also lagged the Zacks Consensus Estimate of $131.8 million by over 9%.

Behind the Headline Numbers

Gross margin in the second quarter was 28.2%, down 360 basis points (bps) year over year, given deleveraging of fixed costs, product mix shifts and closeout sales in some categories.

Adjusted EBITDA (earnings before interest, taxes and amortization) was a negative $5.4 million, compared with the year-ago quarter’s $4.0 million.

2017 View

For 2017, JAKKS Pacific continues to expect higher net income, earnings per share and adjusted EBITDA on lower net sales compared to 2016. Moreover, the company anticipates enhanced profitability in the second half of 2017 due to its efficient marketing undertakings and cost-cutting policies. The company’s continued focus on building its base of evergreen brands and categories as well as entering new categories, creating a strong portfolio of new and existing licenses, and developing owned IP and content are also expected to drive profits.

Other Toymakers

Among other toymakers, Hasbro Inc. (NASDAQ:HAS) reported mixed second-quarter 2017 results, while Mattel Inc. (NASDAQ:MAT) is scheduled to release second-quarter results on Jul 27.

Zacks Rank & Key Pick

JAKKS Pacific currently carries a Zacks Rank #3 (Hold).

A better-ranked stock in the same sector is Nintendo Co (T:7974)., Ltd. (OTC:NTDOY) , sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Nintendo’s fiscal 2018 earnings moved up 5.2% over the last 60 days. Meanwhile, for fiscal 2018, EPS is expected to skyrocket 172.1%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

JAKKS Pacific, Inc. (JAKK): Free Stock Analysis Report

Hasbro, Inc. (HAS): Free Stock Analysis Report

Mattel, Inc. (MAT): Free Stock Analysis Report

Nintendo Co. (NTDOY): Free Stock Analysis Report

Original post