Jacobs Engineering Group Inc. (NYSE:JEC) recently announced its intention to expand its global aviation business to capture the growing demand for aviation services.

To this end, the company has hired personnel for several important positions, including that of a Global Aviation Business Leader. Some of the most notable appointments include those of Steven B. Morris, Stephen M. Pelham, James Chilton and David Tomber.

According to surveys by premium aviation research institutes like International Air Transport Association (‘IATA’) and Airports Council International (‘ACI’), the global aviation industry has scope for robust business growth in spite of headwinds like intense competition or high price volatilities. Several analysts predict that the intensity of air travel would more than double over the next two decades.

Jacobs expects its aviation business revenues and margins to improve over time. Increased passenger and cargo revenues should support top-line growth. Also, higher sales and sharp decline in fuel prices should boost profitability of the aviation business.

Jacobs remains focused on fortifying its aviation business with the aim to forge new public-private partnerships, improve delivery options and enhance construction management.

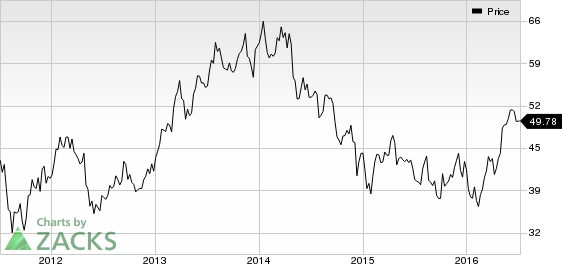

Jacobs shares gained 2.32% on the aforesaid announcement to $49.78 as of Jul 6, 2016. The upside reflects investors’ confidence on the stock.

Zacks Rank and Stocks to Consider

Jacobs currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the industry include ABM Industries Incorporated (NYSE:ABM) , Accenture plc (NYSE:ACN) and Automatic Data Processing, Inc. (NASDAQ:ADP) . All the three companies presently holds a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.Click to get this free report >>

JACOBS ENGIN GR (JEC): Free Stock Analysis Report

ABM INDUSTRIES (ABM): Free Stock Analysis Report

ACCENTURE PLC (ACN): Free Stock Analysis Report

AUTOMATIC DATA (ADP): Free Stock Analysis Report

Original post

Zacks Investment Research