Jacobs Engineering Group Inc (NYSE:J).’s J solid project execution has been one of the main characteristics driving its performance. The latest contract win is a testimony to this.

Recently, Jacobs secured a contract to render essential engineering support to extend the working life of the Koeberg nuclear power plant in South Africa. Located near Cape Town, Koeberg is the only nuclear power plant in South Africa and it produces 5% of the nation’s electricity. The estimated cost of the project is $1.2 billion and is expected to be complete in two years’ time.

Jacobs will provide construction management and support for the improvisation of secondary turbine system. The purview of its work includes prefabrication of piping, pipe supports and refinements, replacement of piping, fixing on-site scaffolding, rigging and lagging, vessel improvisation and replacement or alteration of forced air cooler units.

The main idea of the project is to install six replacement steam generators, each having an average weight of 380 tons and length of 20 meters at the two-reactor plant controlled by Eskom. The first replacement work of the steam generators is scheduled for January 2022.

With respect to this, Energy Security and Technology senior vice president of Jacobs, Karen Wiemelt, said, “To date, this is the largest single contract for our nuclear team in South Africa, which has successfully completed numerous engineering, procurement and construction projects to support operations at Koeberg over the past 30 years.”

Robust CMS Prospects & Share Performance

Critical Mission Solutions or CMS business is one of the major contributing units of Jacobs, which shares space with Altair Engineering Inc. ALTR, KBR (NYSE:KBR), Inc. KBR and AECOM ACM in the Zacks Engineering - R and D Services industry. CMS business (representing 36.6% of fiscal 2020 revenues) serves global automotive, aerospace, telecommunications, defense, and nuclear clients as well as the intelligence community of the United States.

CMS backlog grew 5.5% year over year to $9.57 billion at fiscal third quarter-end, which provided a strong visibility into the base business. The company’s overall 18-month qualified new business pipeline of more than $30 billion remains robust. This segment is benefiting from well-funded government programs and cyber, U.S. Department of Defense or DoD, mission-IT, space, nuclear as well as 5G-related projects.

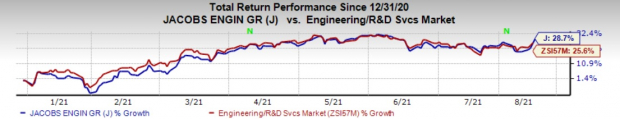

So far this year, Jacobs’ shares have gained 28.7% compared with the industry’s 25.6% rally. The company has been benefiting from increased focus on backlog, acquisitions and efforts to focus on high-value business. The company has shifted its focus to digital and leadership in strategic end markets that include space exploration, life sciences and cyber as well as water solutions.

Image Source: Zacks Investment Research

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Altair Engineering Inc. (ALTR): Free Stock Analysis Report

AECOM (ACM): Free Stock Analysis Report

KBR, Inc. (KBR): Free Stock Analysis Report

Jacobs Engineering Group Inc. (J): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research