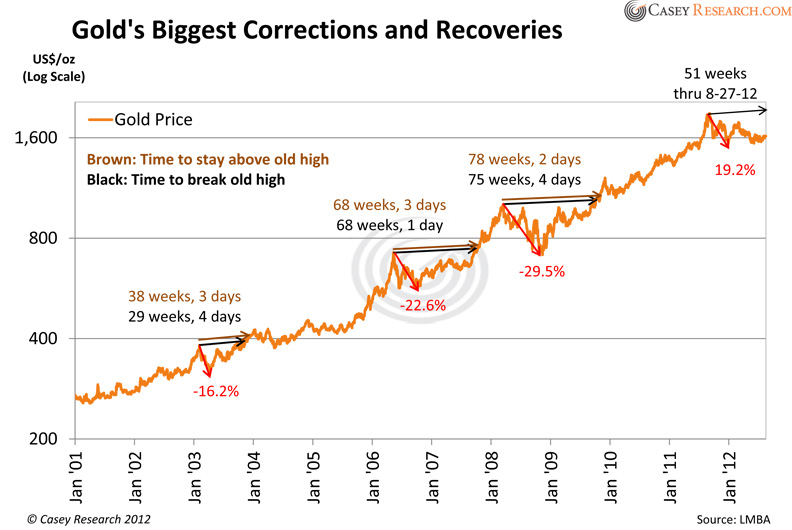

“Your window to buy gold below $1,700 is closing,” according to Casey Research’s Jeff Clark. As seen from the informative chart below, if previous correction and consolidation phases of this bull cycle are any indicator, Clark argues that it is not unreasonably to expect the gold price to have breached its September 5, 2011 record of $1,895/oz (London PM Fix) by Christmas.

The fact that we’re just one month from the fourth quarter – a period in which Indian gold buying increases, owing to it being the country’s wedding season – adds further weight to the idea that we’ll be looking at the $1,600s in the rear-view mirror within the coming weeks or even days.

As Clark points out, September is usually gold’s strongest month of the year. This may not be unrelated to the disproportionately large number of banking crises that tend to occur in that month. Last year was unusual in that we had such a strong showing from gold during July and August, which are usually quiet months for the gold market. So revision to the mean is likely.

We are of course on the cusp of the annual central bank pow-wow at Jackson Hole, Wyoming, with media expectations growing that Federal Reserve Chairman Ben Bernanke will use his Friday morning speech (late afternoon/early evening in Europe) to hint at QE3 or some form of money printing. Fed “kreminologists” will as usual be scanning his every facial expression and word for hints.

Mario Draghi’s decision not to attend the event on Friday has raised eyebrows – as well as expectations that the European Central Bank is likewise cooking up a new money-printing splurge. Draghi’s cause received a boost yesterday from Jörg Asmussen, a German member of the ECB’s executive board, who stated in a speech that ECB bond purchases were needed to free up credit to businesses.

This dovish stance from such a senior German official is, along with Angela Merkel’s increasingly conciliatory tones, further evidence that German resistance to money printing is softening when confronted with all the old rhetoric about the inevitability and wonders of European political integration. And yet more fuel for gains in precious metal prices.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Jackson Hole Symposium Beckons

Published 08/29/2012, 07:26 AM

Updated 05/14/2017, 06:45 AM

Jackson Hole Symposium Beckons

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.