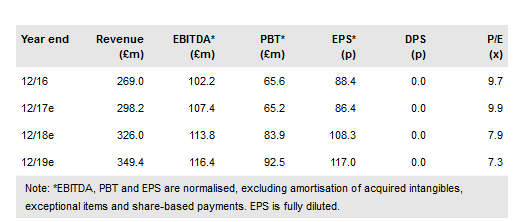

Jackpotjoy plc (JPJ) is the clear leader in the c £800m UK bingo-led market, with exceptionally high EBITDA margins and strong cash flow. The group’s balance sheet is simplifying following a major earnout payment and we expect it to reach 2.0x net debt/EBITDA in 2019. With four sets of strong quarterly figures under its belt, JPJ’s shares have risen 42% since the January listing in London. Nonetheless, at 7.9x P/E, 8.2x EV/EBITDA and 11.7% free cash flow yield for 2018e, the stock still trades at a significant discount to peers and we believe the re-rating will continue as value steadily transfers from debt to equity.

Market dominance and high free cash flow

JPJ has a 23% market share in the c £800m UK bingo-led market, with additional growth in other markets, including Spain and Sweden. We forecast 9% revenue CAGR for 2016-19, which is broadly in line with industry growth estimates, and offsets an estimated 600bp drop in EBITDA margin, from the impact of rising gaming taxes. During 2017, JPJ paid a £94.2m earnout to Gamesys and has made significant progress in simplifying its balance sheet. Although the group remains relatively indebted (3.3x FY17e adjusted net debt/EBITDA), it currently generates c £100m operating cash flow per year and is comfortably positioned to cover the £44m earnout payment in June 2018. Leverage should then reduce rapidly.

To read the entire report Please click on the pdf File Below: