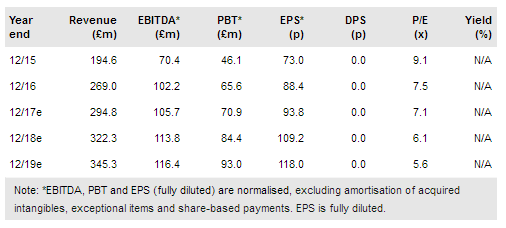

Jackpotjoy PLC (LON:JPJ) has produced another set of robust quarterly earnings, with Q217 revenues increasing 17% to £75.2m and a 39.9% EBITDA margin. The core Jackpotjoy division grew 18% and is gaining market share. Q3 has started well, management has reiterated its expectations for FY17 and our forecasts remain unchanged. The stock trades at a significant discount to peers, with 2018e multiples of 7.2x EV/EBITDA, 6.1x P/E and 15.0% free cash flow yield. The balance sheet is simplifying following a major earn-out payment and, as the company continues to demonstrate its market dominance, we would expect a re-rating in the shares.

Continued momentum, forecasts unchanged

Q2 revenues grew by 17% to £75.2m, primarily driven by an 18% increase in the core Jackpotjoy division. Mandalay has reversed the decline in Q117 and is up 10% sequentially. Benefiting from currency, Vera&John grew 30% vs Q216. Average LTM active customers increased 13% to 243,896 vs the prior year and average real money gaming (RMG) per month grew 16% to £21.8m. The Q2 adjusted EBITDA margin of 39.9% is expected to decline in H217, with the impact of higher gaming taxes as well as a significant marketing campaign. Our forecasts remain unchanged.

To read the entire report Please click on the pdf File Below: