Jack in the Box Inc. (NASDAQ:JACK) just released its first-quarter 2018 financial results, posting adjusted earnings of $1.23 per share and revenues of $294.46 million. Currently, JACK is a Zacks Rank #3 (Hold) and is up marginally to $88 per share in after-hours trading shortly after its earnings report was released.

JACK:

Beat earnings estimates. The company posted adjusted earnings of $1.23 per share, beating the Zacks Consensus Estimate of $1.06 per share.

Beat revenue estimates. The company saw revenue figures of $294.46 million, topping our consensus estimate of $285.94 million.

Jack in the Box revenues fell by more than $50 million from the year-ago period. Qdoba generated a quarterly net loss, after helping add $1.4 million in the year-ago period. But the firm’s first quarter fiscal 2018 sale of Qdoba is expected to close by April 2018.

Jack in the Box expects full-year same-store sales will increase between 1% and 2% at system restaurants.

"We are working with our advisors to adjust our capital structure to reflect a less capital-intensive business model, and we remain committed to returning cash to shareholders,” CEO Lenny Comma said in a statement.

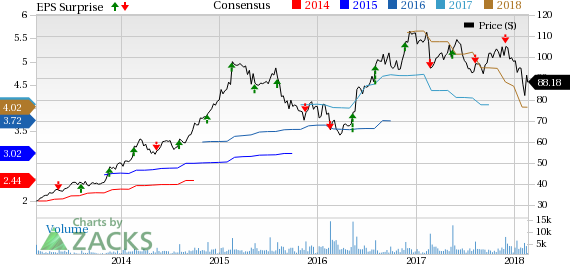

Here’s a graph that looks at JACK’s Price, Consensus and EPS Surprise history:

Jack in the Box, Inc. is a restaurant company that operates and franchises Jack in the Box restaurants, one of the nation's largest hamburger chains, and Qdoba Mexican Eats, a leader in fast-casual dining.

Check back later for our full analysis on JACK’s earnings report!

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Jack In The Box Inc. (JACK): Free Stock Analysis Report

Original post