Jack in the Box (O:JACK) stock had a great run higher in 2014, back when falling oil prices were supposed to be good for dining out, or whatever the narrative was. But 2015 was not so great for the stock price, it has pulled back by that magical Fibonacci ratio of 38.2% from the top near 100 and has been consolidating in a range since September.

Looking a bit more closely at the consolidation shows an opportunity for a trade. Three different views show this stock may be spring loaded for a move higher. Long time readers know I love when this type of mosaic of technicals come together.

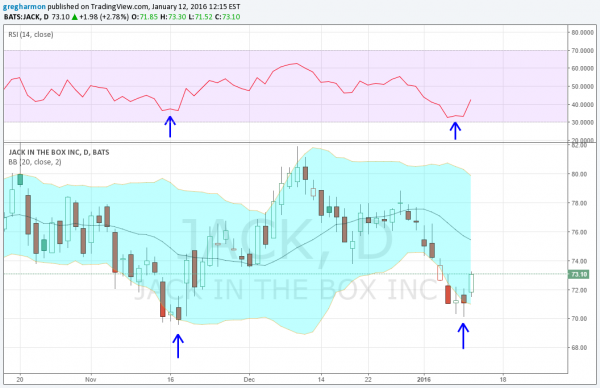

The first thing to look at is the stock is at the bottom of the channel from 70 to 85. The Japanese Candlesticks from Friday last week and Monday are potential reversal candles and they are being confirmed today. The second is a Positive RSI Reversal. This occurs when the RSI makes a new lower low in a pullback while the price does not. The Positive RSI Reversal gives a target to 82.48. Finally, it is moving higher off of the lower Bollinger Band®.

All three of these combined give a very lucrative trade potential with a solidly defined risk point. Using a stop lose at 70 gives a better than 3:1 reward to risk ratio.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.