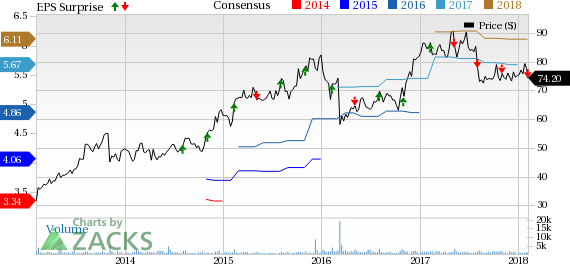

j2 Global, Inc.’s (NASDAQ:JCOM) fourth-quarter 2017 earnings (excluding 77 cents from non-recurring items) of $1.79 per share missed the Zacks Consensus Estimate by a couple of cents. However, the bottom line climbed 20.1% on a year-over-year basis on the back of higher revenues.

Quarterly revenues came in at $316.4 million, up 25.6% year over year and ahead of the Zacks Consensus Estimate of $314.5 million. Segment wise, total Cloud Service revenues increased 2.7% year over year to $146.9 million in the reported quarter. Digital Media revenues logged $169.5 million, up 55.8%.

j2 Global’s operating expenses were $194.19 million in the quarter under review, up 35.4% from the same period last year. Quarterly adjusted EBITDA (earnings before interest, tax, depreciation and amortization) rose 21.8% year over year to $141.9 million.

j2 Global exited the fourth quarter of 2017 with approximately $350.95 million in cash and cash equivalents compared with $123.95 million at the end of 2016. Long-term debt during the period was $1 billion compared with $601.75 million at the previous year-end. Also, free cash flow decreased 8.9% year over year to $75.3 million during the quarter under discussion.

2018 Outlook

The company expects revenues between $1.20 billion and $1.25 billion for 2018. While adjusted earnings per share for the period is anticipated between $5.95 and $6.25. The Zacks Consensus Estimate for current-year earnings is pegged at $6.11 on revenues of $1.19 billion. Additionally, it projects adjusted EBITDA in the band of $480-$505 million for the same time frame. Also, adjusted effective tax rate for the year is estimated between 23% and 25%.

Dividend Hike & Extension of Share Repurchase Program

The company’s board has raised its quarterly cash dividend by 2.5% to 40.5 cents per share. The dividend will be paid on Mar 9 to shareholders of record as of Feb 22.

Further, the company has extended the existing 5 million share repurchase program by a year. Initially, it was a one-year program with the date of expiry set on Feb 19, 2018. Nearly 1.9 million shares are yet to be bought back under the revised authorization.

Zacks Rank & Key Picks

j2 Global carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader Computer and Technology sector are Twitter, Inc. (NYSE:TWTR) , COUPA SOFTWARE (NASDAQ:COUP) and AMETEK, Inc. (NYSE:AME) , each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Shares of Twitter, COUPA SOFTWARE and AMETEK have gained more than 28%, 16% and 8%, respectively, in the last three months.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

j2 Global, Inc. (JCOM): Free Stock Analysis Report

Twitter, Inc. (TWTR): Free Stock Analysis Report

COUPA SOFTWARE (COUP): Free Stock Analysis Report

AMETEK, Inc. (AME): Free Stock Analysis Report

Original post

Zacks Investment Research