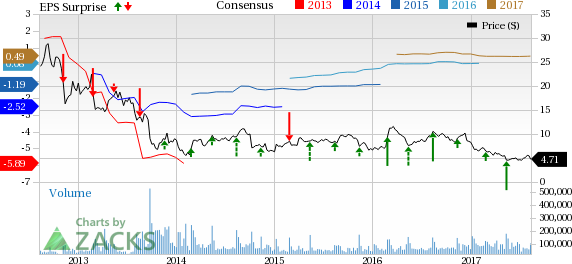

J. C. Penney Company, Inc. (NYSE:JCP) reported second-quarter fiscal 2017 adjusted loss per share of 9 cents, wider than the Zacks Consensus Estimate of a loss of 6 cents. In the year-ago quarter, the company had reported loss of 5 cents.

Earnings Estimate Revision: The Zacks Consensus Estimate for fiscal 2017 has been portraying an uptrend over the past 30 days. In the trailing four quarters (excluding the quarter under review), the company outperformed the Zacks Consensus Estimate by an average of 50.9%.

Revenues: J. C. Penney generated total net sales of $2,962 million that increased 1.5% year over year, and also surpassed the Zacks Consensus Estimate of $2,870 million. Comparable sales declined 1.3% in the quarter.

Outlook: Management reiterated fiscal 2017 guidance. The company continues to expect comparable store sales to be in the range of down 1% to up 1% in fiscal 2017. The company expects adjusted earnings per share for fiscal 2017 to be in the range of 40 cents to 65 cents. The Zacks Consensus Estimate for fiscal 2017 is currently pegged at 49 cents.

Zacks Rank: Currently, J. C. Penney carries a Zacks Rank #1 (Strong Buy) which is subject to change following the earnings announcement. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stock Movement: J. C. Penney shares are down roughly 15% during pre-market trading hours following the earnings release.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

J.C. Penney Company, Inc. Holding Company (JCP): Free Stock Analysis Report

Original post

Zacks Investment Research