J.B. Hunt Transport Services Inc. (NASDAQ:JBHT) performed impressively in the fourth quarter of 2017. Evidently, it posted better-than-expected earnings per share and revenues in the quarter.

This transportation company’s earnings (excluding $2.44 from non-recurring items) of $1.04 per share edged past the Zacks Consensus Estimate of $1.03. The bottom line also improved 7.2% on a year-over-year basis despite higher operating expenses. In fact, the 16% year-over-year increase in revenues aided results. Revenues also surpassed the Zacks Consensus Estimate of $1.93 billion.

Operating income decreased 25% to $146 million (on a reported basis). However, excluding fuel surcharges, the measure increased 13% year over year.

During the quarter under review, this Zacks Rank #3 (Hold) company did not repurchase shares. The company stated that $521 million were remaining under its share buyback program as of Dec 31, 2017. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Segmental Performance

The Intermodal division reported quarterly revenues of $1.1 billion, up 10% year over year. Overall volumes in the segment climbed 5%. Revenue per load, excluding fuel surcharge revenues, increased 2% on a year-over-year basis. Operating income declined 25% year over year due to higher costs.

Dedicated Contract Services revenues increased 20% year over year to $477 million. The company added new trucks to the fleet in the fourth quarter while customer retention rates remained above 98%. Operating income decreased 39% year over year to $34.9 million, primarily due to increased costs like driver wages.

Integrated Capacity Solutions revenues surged 40% year over year to $323 million. Revenue per load improved 19% on a year-over-year basis. Load volumes increased 17% as well. Operating income surged 86% mainly owing to increased spot market activity.

Truck revenues increased 1% to $97 million. At the end of the quarter, J.B. Hunt operated 2,032 tractors decreased 4.5% year over year. Trailers decreased 6.8% to 7,120 in the quarter under review. Operating income also declined 5% to $6.4 million due to favorable factors like higher revenue per load.

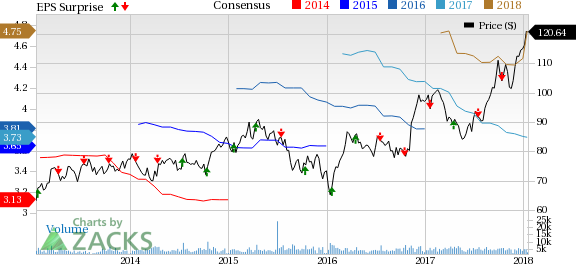

J.B. Hunt Transport Services, Inc. Price, Consensus and EPS Surprise

Liquidity

At the end of the fourth quarter, cash and cash equivalents were $14.61 million compared with approximately $6.38 million at the end of 2016.

Long-term debt was $1.09 billion compared with $986.28 million at the end of the previous year.

Upcoming Releases

Investors interested in the Zacks Transportation sector are keenly awaiting for fourth-quarter earnings reports from key players like Kansas City Southern (NYSE:KSU) , Canadian National Railway Company (NYSE:CNI) and Norfolk Southern Corp. (NYSE:NSC) in the coming days. While Kansas City Southern is scheduled to report on Jan 19, Canadian National and Norfolk Southern are scheduled to report on Jan 23 and Jan 24, respectively.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

Kansas City Southern (KSU): Free Stock Analysis Report

Canadian National Railway Company (CNI): Free Stock Analysis Report

Norfolk Souther Corporation (NSC): Free Stock Analysis Report

J.B. Hunt Transport Services, Inc. (JBHT): Free Stock Analysis Report

Original post

Zacks Investment Research