This is the time of year when soybeans typically start performing well -- usually but not always. Also, for the record, I am a few days late with this one but so far beans haven’t really gone anywhere so no harm, no foul.

(See also The Long and Short of Strangling Small Caps)

Seasonal Beans

Figure 1 displays the annual seasonal trend for soybean futures.

One “typically” favorable period extends from the close on February Trading Day of the Month (TDM) #8 (which was February 10 of 2016) through the close of May TDM #1.

Figure 2 displays the annual gain/loss from holding a long position in soybean futures during this period each year starting in 1978.

Figure 2 – Annual gain/loss from holding long 1 soybean futures contract from Feb TDM 8 through May TDM 1 (1978-2016)

Figure 3 displays the cumulative gain/loss.

Figure 3 – Cumulative growth of equity from holding long 1 soybean futures contract from Feb TDM 8 through May TDM 1 (1978-2016)

For The Record

- # years showing a gain = 29 (74%)

- # years showing a loss = 10 (26%)

- Average gain =+$3,523

- Average loss = -$1,597

Please note that there is a difference between 74% accurate and “You Can’t Lose Trading Beans!”

The majority of investors will never even consider trading soybean futures (which truth be told is probably a good thing). But there are alternatives. The ETF SOYB is designed to track soybean futures while trading like a stock.

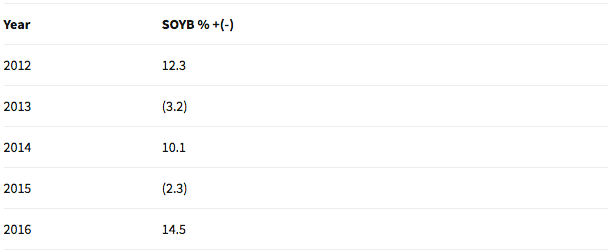

Figure 4 displays the year-by-year percentage gain or loss achieved by holding SOYB from the end of Feb TDM 8 through May TDM 1 since SOYB started trading (in November of 2011).

Figure 5 displays a chart of ticker SOYB during the Feb-to-May period in 2016 (Just remember it doesn't always go this well).

Figure 5 – ETF ticker SOYB in 2016

(See also This May Be a Good Time to Get Crude)

Summary

To be clear, I have no idea if soybeans will perform well during the Feb to May period this time around and I am not recommending that you buy soybeans futures contract or shares of ticker SOYB.

That said, at least you're now aware of the potential opportunity.