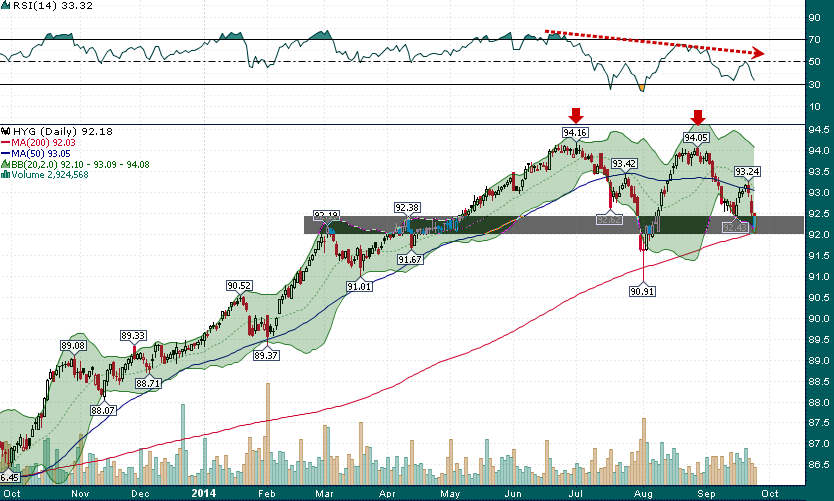

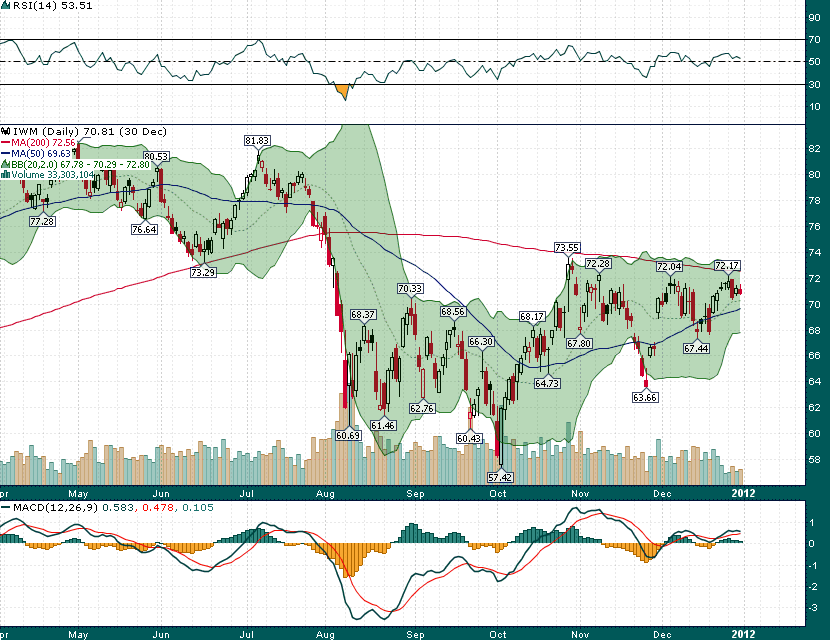

Since Friday morning equities have formed a rare bearish reversal pattern and the Russell 2000 ETF (ARCA:IWM) is on the verge of making a controversial ‘death cross’. However, perhaps most alarming is the fact that high-yield corporate bonds are on the verge of breaking down through a key area of support and the 200-day simple moving average:

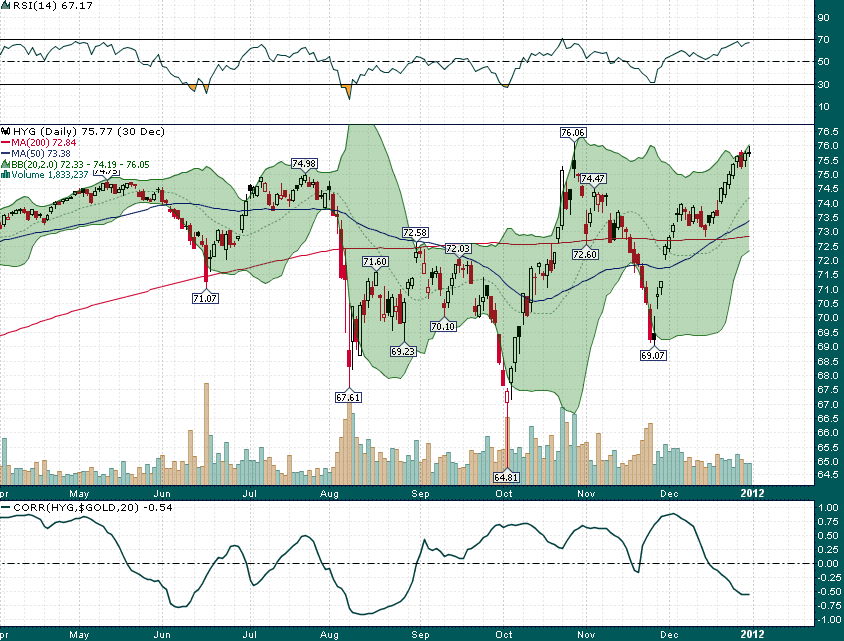

Given that high-yield corporate bonds have long held a strong positive correlation with equities, a break below the 200-day SMA, which could signal the beginning of new downtrend, would be a very ominous sign for financial markets as a whole. Interestingly enough, the last time that the high-yield corporate bond ETF (ARCA:HYG) broke its 200-day SMA in conjunction with a death cross in IWM was August 2011:

What else happened in August 2011?

Gold jumped $300/ounce and made an all-time high near $2,000/ounce!

With the extreme levels of bearishness on Gold currently and the fact that the yellow metal is close to major support near $1180-$1200, raising ones net portfolio exposure to gold seems like a prudent decision given the growing number of storm clouds across financial markets.