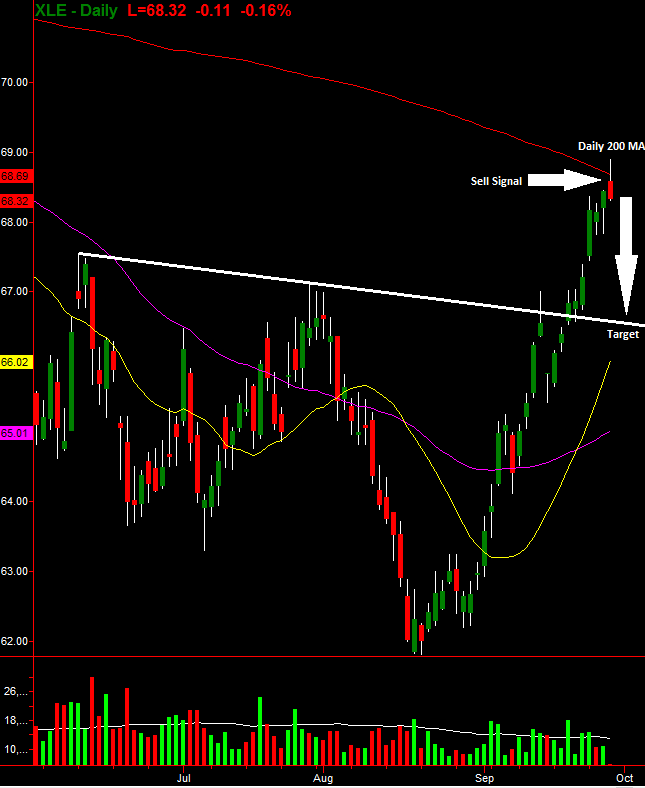

The energy ETF XLE is a strong short based on its technicals.

Point A: After surging since mid August from under $62 to a high on Thursday of $68.90, XLE hit the daily 200 moving average — a monster move in a very short time frame.

Point B: Oil is trading in the upper range around $52. Just weeks ago, it was near $45, at the low end of the range, which has been active for most of 2017 and continues to hold.

Point C: XLE is pulling back off the daily 200 moving average, forming a topping tail, which is a great sign of reversal.

Based on these factors, I alerted members to buy puts on XLE on the assumption that price will fall to the $66-$66.50 range.