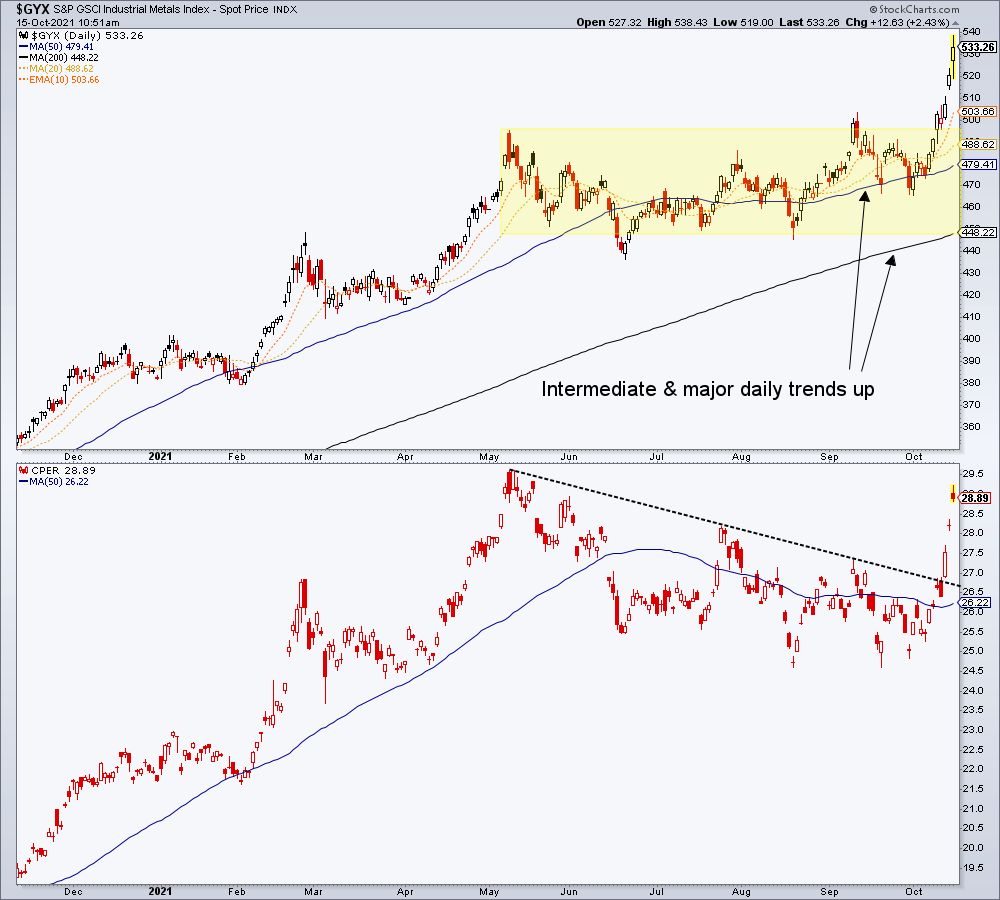

While copper went through its correction we have been noting each week that the Industrial Metals index, GYX ,had never aborted its bullish stance. Trends remained up and the index price held the SMA 50’s intermediate trend all the while copper (CPER, which I hold, in lower panel) worked through its summer correction.

The Industrial Metals are a primary indicator of cyclical inflation and by extension, economic reflation.

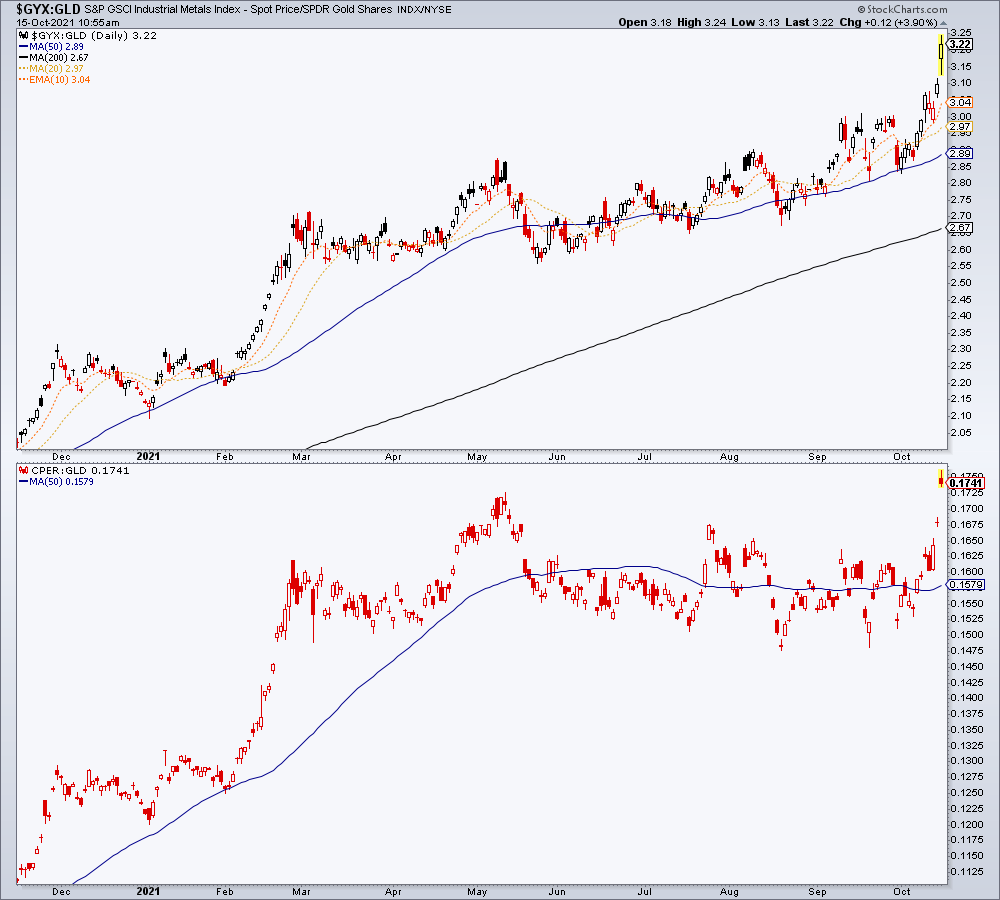

The implications on the macro level were and still are many, including that it is not yet time to be a gold bull, at least not yet time to focus on it as anything special in the price casino. That time will come, but not in any time convenient to those cheering for the monetary metal. Value knows not about time. Value cares not about time.

Here is the same chart as adjusted by gold. Bullish, risk ‘on’ and cyclical still.