Today is the big day, of course. Powell time again. Two hours before the market closes, the announcement rolls out, and half an hour later, the Fed chair does his press conference.

As always, caution will prevail, and every syllable will be selected carefully. Added to which, whatever movements the market makes immediately following the announcement won’t mean much. It usually takes until at least the market close before some kind of clarity is there with respect to reaction.

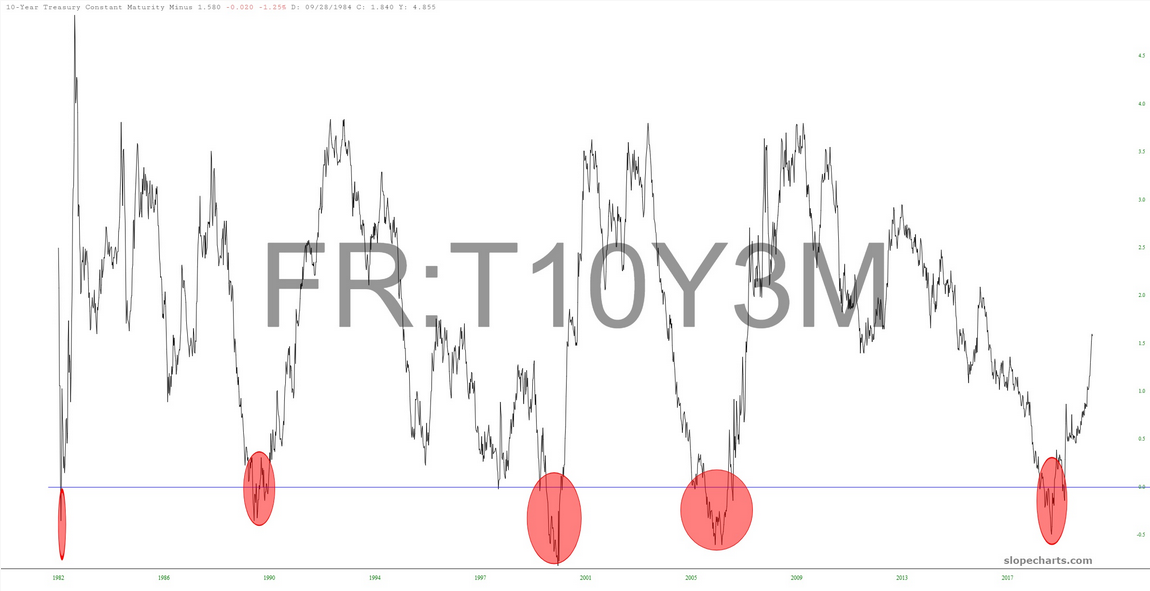

For many months, the 10-year minus 3-month has been recovering from its “a recession is here” depths.

This bounce is illustrated below with simply the ten year. Interestingly, this chart was hammering out a very nice bullish saucer until all hell broke loose, and the saucer failed. What’s quite intriguing is that the price action is simply moving it back to the perimeter of the same saucer: think of support (the green tint) now acting as resistance.

If, in fact, interest rates do sink later today, will bonds obviously will shoot up. This makes sense with respect to the iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) chart as well, because this thing has done almost nothing but sink for the past year, and there’s plenty of space for a hearty bounce higher.