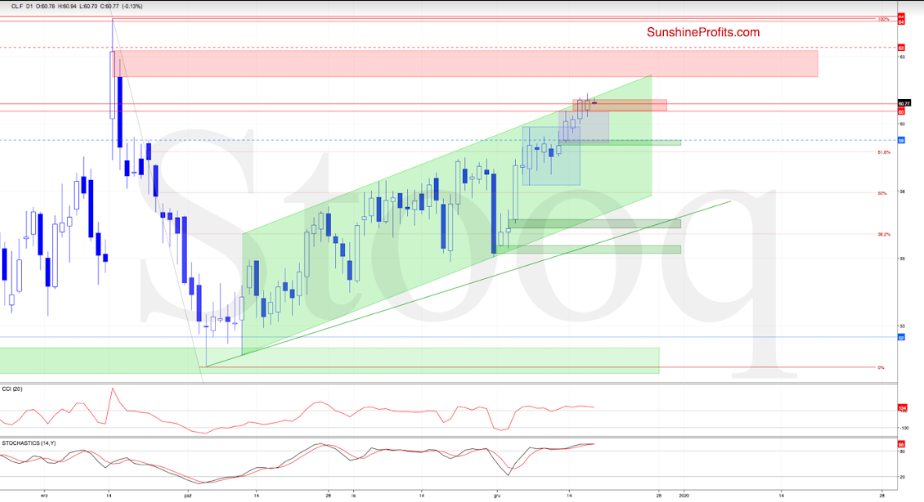

Although crude oil futures again moved higher during yesterday’s session, rising above the upper border of the rising green trend channel and 78.6% Fibonacci retracement, the bulls didn’t manage to hold gained ground. This very same development characterized action in oil a day earlier too.

Earlier today, the futures opened with another bearish gap, invalidation all yesterday’s breakouts. This is certainly a bearish development.

The daily indicators are still very extended, also supporting the likelihood of upcoming resolution to the downside.

Should the futures extend losses from here, the initial downside target for the sellers will be the Friday’s green gap.

Summing up, while the bulls appeared to have made a breakthrough on a closing basis yesterday or the day before, the following day’s bearish opening speaks differently. The lower border of the red resistance zone continues to keep further gains in check. This zone is marked by the upper border of the rising green trend channel, and the 76.4% and 78.6% Fibonacci retracements. The extended daily indicators support a downside reversal too. The short positions continues being justified from the risk-reward perspective.