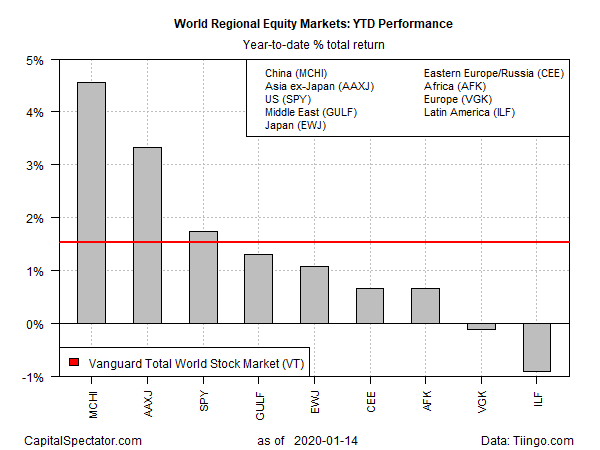

The broad upside momentum for most slices of the world’s equity markets has spilled over into 2020, at least so far. But the distribution of performance, as usual, is uneven. Here’s a quick look at how the bull run stacks up so far (through Jan. 14) for U.S. and global stock markets, based on a set of exchange-traded funds.

Let’s start with a top-down view of the world by dividing markets into the major geographic slices. On this dimension, China’s taken the lead with a strong run in 2020 after a middling performance last year. Indeed, the year-to-date rise of iShares MSCI China ETF (NASDAQ:MCHI) is enjoying a world-beating advance. The fund is up 4.6% so far this year, far above the rest of the field, including the global equity benchmark via Vanguard Total World Stock Index Fund ETF Shares (NYSE:VT), which is up 1.5% year to date.

At the moment there are two regional losers for 2020: Vanguard FTSE Europe Index Fund ETF Shares (NYSE:VGK)) and iShares Latin America 40 (ILF), which is posting the deepest shade of red via a 0.9% decline this year through yesterday’s close.

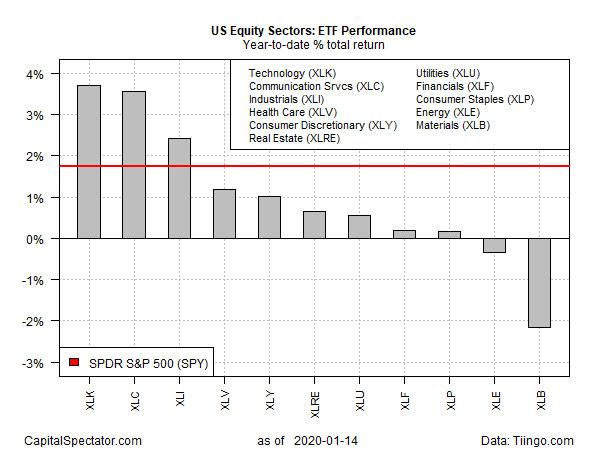

Turning to a sector-based review of the US equity market, technology and communications services are dominating this year’s gains. These two slices of the total market are neck-and-neck so far in 2020. Posting a slightly stronger gain: Technology Select Sector SPDR (XLK), which is up 3.7% year to date. A close second: Communication Services Select Sector SPDR (XLC), currently ahead by 3.6%.

The two losers in the sector space at the moment: energy and materials, with the latter suffering the biggest year-to-date decline: Materials Select Sector SPDR Fund (NYSE:XLB) is off 2.2%.

For context, note that the broad U.S. market, based on the SPDR S&P 500 (SPY (NYSE:SPY)), is comfortably in positive terrain with a 1.7% year-to-date rise.

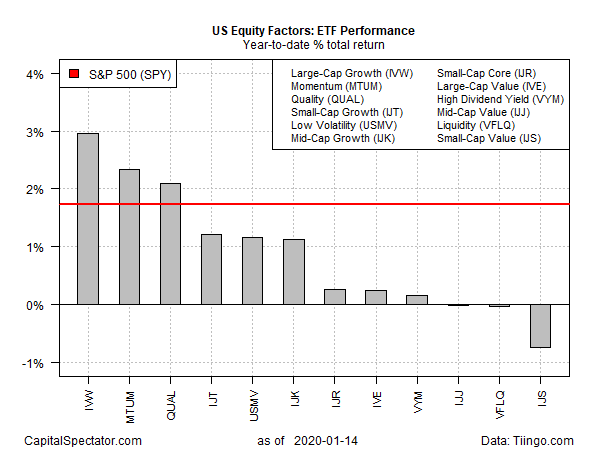

Looking at U.S. markets through a factors lens reveals that large-cap growth is comfortably in the lead so far in 2020. After a strong run last year, iShares S&P 500 Growth ETF (NYSE:IVW) shows no sign of slowing: the fund is up 3.0% year to date, well ahead of the rest of the field.

The biggest loser in the factor horse race so far this year: small cap value via iShares S&P Small-Cap 600 Value (IJS), which is down 0.8%.

Overall, it’s fair to say that it’s been a good year so far… for most corners of US and foreign markets. Then again, the year is young and there are plenty of risk factors lurking, domestic and offshore. The key question for the year ahead: Will stocks continue to climb a wall of worry?