By Murray Gunn

The European project is on ever more shaky ground as Italy confirms an economic slump.

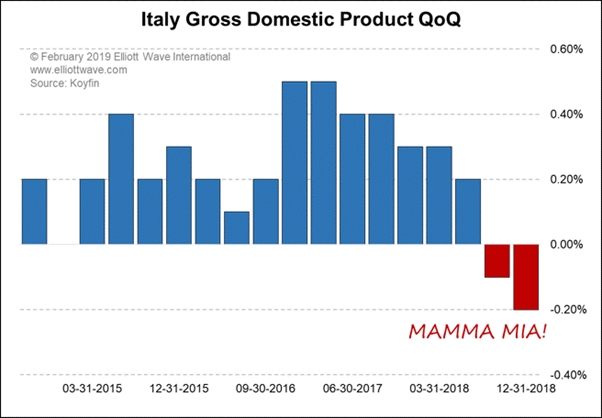

Italian Gross Domestic Product (GDP) fell by 0.2% in the fourth quarter of 2018. Having already contracted by 0.1% in the third quarter, the second consecutive quarter of decline puts Italy officially in economic recession. To watchers of the Italian stock market, of course, this lagging news is not unexpected. With the Milano Indice di Borsa (MIB) down by 25% from its May 2018 peak to the end of the year, the forward-looking barometer of business conditions was telling anyone paying attention that the Italian economy was suffering. The stock market leads the economy.

In March, the MIB will have been in a bear market for 19 years. It’s the same for the Euro STOXX, an index of companies across the Eurozone as a whole. 19 years! Forget about Japan’s lost decade; how about Europe’s lost decADES. The decline in the Euro STOXX reflects a long-term decline in society’s mood, and we anticipate dramatic social actions as a result. Proponents of the European project must be feeling apprehensive. In this regard, the current Brexit impasse has become crucial. Any hint that the European Commission is making it easier for Britain to leave the European Union without damaging consequences will be fuel to the fire of nationalist causes in Italy, France and beyond. The wonks in Brussels are desperate for an acceleration towards political and fiscal union because they realize that is the only chance of Europe staying together in the long-term. Our hypothesis, however, is that it’s much more likely that Europe will tear itself apart.

Murray Gunn is Head of Research for Elliott Wave International’s Global Market Perspective, a monthly summary of the firm’s 25 analysts’ views on every major freely-traded market in the world. After earning his Master of Arts (Honors) degree in Economics from the University of Dundee in Scotland in 1991, Gunn went into fund management. He quickly realized that textbook descriptions don’t apply to real-world markets, which in turn led him to technical analysis and the Elliott Wave Principle. He worked as a fund manager in global bonds, currencies and stocks, including long posts at Standard Life (LON:SLA) Investments and a five-year stint in the Middle East at the Abu Dhabi Investment Authority. Gunn then joined HSBC as Head of Technical Analysis. He has served on the board of the Society of Technical Analysts and delivered lectures on the Elliott Wave Principle to students at The London School of Economics, Queen Mary University and Kings College London. You can read Gunn’s commentary in Elliott Wave International’s Global Market Perspective, Interest Rates and Currency Pro Services, and on deflation.com.