Italy heading for new elections

- As the Italian president appointed Carlo Cotarelli as Prime Minister yesterday, 5S and League announced that the appointment would not be tolerated, signaling new elections. League leader Matteo Salvini, stated that the country is occupied financially and populist’s rhetoric in general, seems to consider the possible elections as an EU- euro referendum. What seemed like a life raft for the common currency, could evolve into a nightmare, as there seems to be a qualitative change forming in the anti-systemic parties. Specifically, the anti-euro rhetoric now places the euro issue far more in the open as before the elections and Brussels could have a large crisis in their hands. Angela Merkel said on Monday she would work with any coalition government formed in Italy, but she also warned that any discussions on economic policy would have to be within the rules governing the eurozone. Further news on the instability in the eurozone could make the EUR weaker.

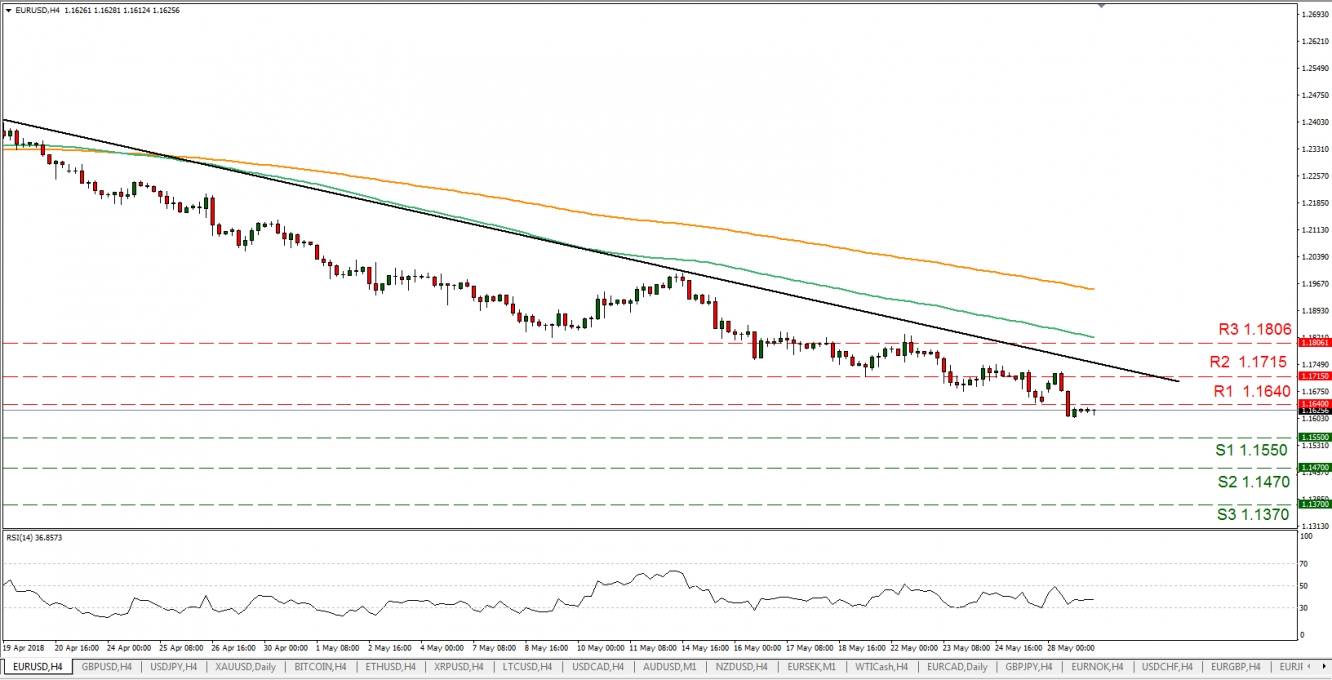

- EUR/USD dropped yesterday, breaking the 1.1640 (R1) support level (now turned to resistance) and then continued to hover just below it. Currently, we maintain our bearish bias for the pair, as it continues to trade below the downward trend line incepted since the 20th of April and the fundamentals do not seem to favor the common currency. Should the bears continue to be in charge, we could see the pair reaching or even breaking the 1.1550 (S1) support line. Should the bulls take over, the pair could break the 1.1640 (R1) resistance line and aim for the 1.1715 (R2) resistance hurdle.

Preparations for Trump-Kim meeting continue

- Japanese media suggested that a top aide to North Korea’s leader landed in Singapore yesterday for further preparations regarding the Trump–Kim meeting. At the same time, a US team of officials also left for Singapore, in order to meet the North Koreans. It should be noted that South Korea’s president Moon stated on Monday that there could be more meetings and talks with North Korea. Should there be further positive headlines about the meeting we could see JPY weakening.

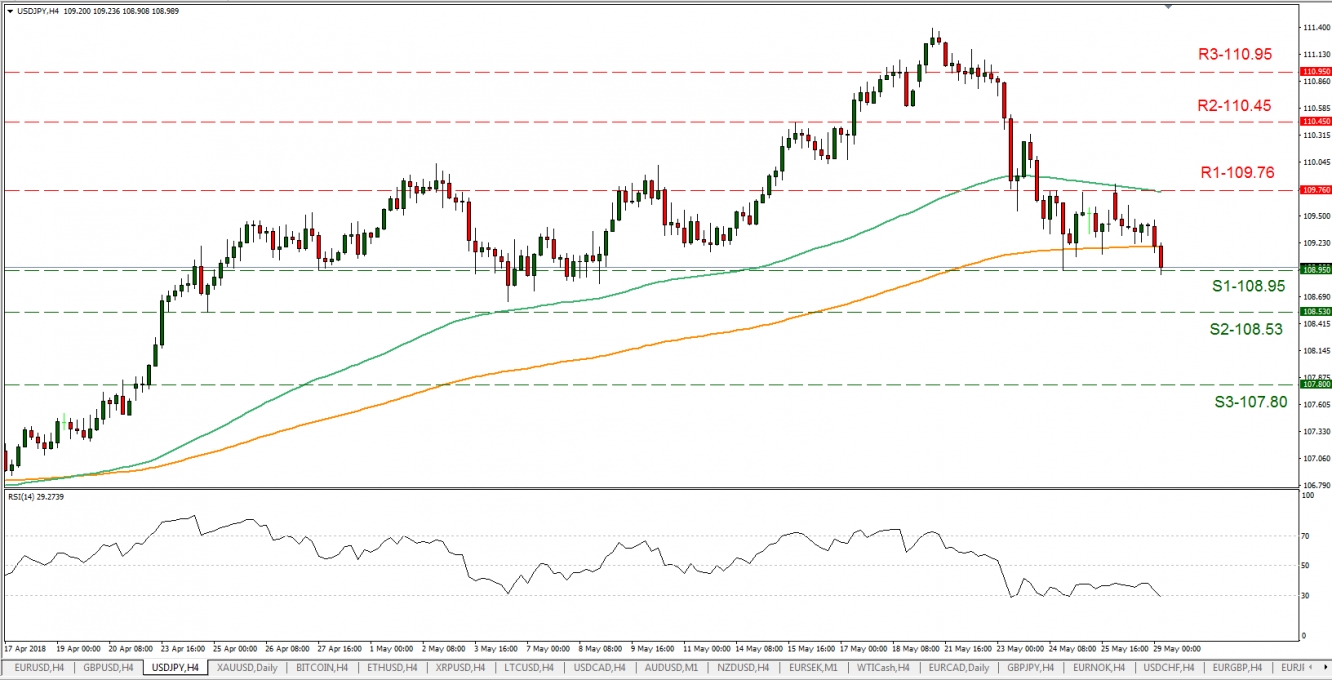

- USD/JPY dropped yesterday testing the 108.95 (S1) support line reflecting the strengthening of the yen, as per analysts. The pair could trade in a sideways manner today with some bearish tendencies. Should the pair come under selling interest, it could break the 108.95 (S1) support line and aim for the 108.53 (S2) support level. Should it find fresh buying orders along its path, we could see it reaching or even breaking the 109.76 (R1) resistance line.

In today’s other economic highlights:

- In the European session, we get France’s and Sweden’s Consumer Confidence for May and in the American session, we get the US Consumer Confidence indicator for May. As for speakers, ECB’s Mersch and Lautenschlaeger speak.

EUR/USD

·Support: 1.1550(S1), 1.1470(S2), 1.1370(S3)

·Resistance: 1.1640(R1), 1.1715(R2), 1.1806(R3)

USD/JPY

·Support: 108.95(S1), 108.53 (S2), 107.80 (S3)

·Resistance: 109.76 (R1), 110.45 (R2), 110.95 (R3)