I’m not sure how many times we have been told that this is a “crucial week for the Eurozone” in the past 12 months but the total can increase by one once more. Deals on a fiscal union within the Eurozone are said to be closer than ever following empassioned speeches by Sarkozy and Merkel on Thursday and Friday respectively, although there are still divisions over possibly the most vital point of the deal; whether countries within this union should be penalised if budget levels are broken. Sarkozy is unwilling to let these powers go and Merkel will get another crack at persuading him to do so today before the scheduled Eurozone meeting at the end of the week. No announcements are expected from the Merkel/Sarkozy meeting which means that any announcement that is forthcoming has the ability to be a bombshell.

This week has been choreographed by European leaders to put over an air of confidence and capability to the markets. The opening dance was from Italy with Mario Monti’s technocratic government approving austerity measures and further fiscal tightness. The changes and spending cuts total around EUR30bn over the next three years. Some of this will be ploughed back into the economy to try and get Italy working again with particular focus being put on the young and female unemployment. Other measures such as another VAT increase may come through in the second half of 2012 if needed.

Friday’s trade was slow as markets waited for, and then digested, the November Non-Farm payrolls figures. Payrolls increased by 120k, just below the consensus figure of 120k however, the unemployment rate fell from 9.0% to 8.6%. While that seems like good news a part of it will be as a result of the “participation rate” falling as well. This rate measures the size of the labour force versus those of the same age and unfortunately falls are not seen as a positive i.e. the fall in the unemployment rate is not as a result of people getting jobs but instead as a result of people falling out of the labour force. We saw risk trade in a fairly whippy manner through the afternoon session but without any real direction.

Markets have opened positively so far this morning on the back of the Italian news with Italian bond yields the best performers of the day, coming in by 7bps. Equity markets are expected to open in the Green as well and the euro is looking resurgent once again this morning. We are still in our well-defined ranges on GBP/EUR (1.14-1.17) and GBP/USD (1.54-1.57) and we expect that the market will eagerly attempt to push the euro higher and dollar lower on good exchanges coming from meetings surrounding the Eurozone’s future.

Following the poor European manufacturing numbers from Thursday we get a look at the services sector today with Italy (08.45), France (08.50), Germany (08.55), Europe as a whole (09.00) and the UK (09.30) all set to report that growth in the services sector is set to remain negative or very weak indeed. The UK number surprised to the upside last month as pre-Christmas sales tempted shoppers on to the High St. We will see whether that trend has continued or whether the demand was simply poached from months further down the line. We also receive Eurozone retail sales at 10.00 and US ISM at 15.00.

Fundamentals are all well and good but are about as permanent as a rainbow at the moment and the focus will remain on Europe.

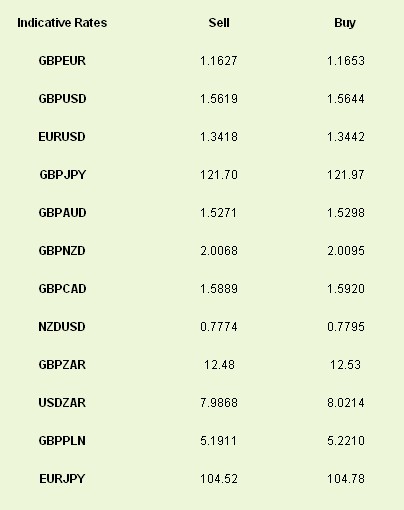

Latest

exchange rates at time of writing

This week has been choreographed by European leaders to put over an air of confidence and capability to the markets. The opening dance was from Italy with Mario Monti’s technocratic government approving austerity measures and further fiscal tightness. The changes and spending cuts total around EUR30bn over the next three years. Some of this will be ploughed back into the economy to try and get Italy working again with particular focus being put on the young and female unemployment. Other measures such as another VAT increase may come through in the second half of 2012 if needed.

Friday’s trade was slow as markets waited for, and then digested, the November Non-Farm payrolls figures. Payrolls increased by 120k, just below the consensus figure of 120k however, the unemployment rate fell from 9.0% to 8.6%. While that seems like good news a part of it will be as a result of the “participation rate” falling as well. This rate measures the size of the labour force versus those of the same age and unfortunately falls are not seen as a positive i.e. the fall in the unemployment rate is not as a result of people getting jobs but instead as a result of people falling out of the labour force. We saw risk trade in a fairly whippy manner through the afternoon session but without any real direction.

Markets have opened positively so far this morning on the back of the Italian news with Italian bond yields the best performers of the day, coming in by 7bps. Equity markets are expected to open in the Green as well and the euro is looking resurgent once again this morning. We are still in our well-defined ranges on GBP/EUR (1.14-1.17) and GBP/USD (1.54-1.57) and we expect that the market will eagerly attempt to push the euro higher and dollar lower on good exchanges coming from meetings surrounding the Eurozone’s future.

Following the poor European manufacturing numbers from Thursday we get a look at the services sector today with Italy (08.45), France (08.50), Germany (08.55), Europe as a whole (09.00) and the UK (09.30) all set to report that growth in the services sector is set to remain negative or very weak indeed. The UK number surprised to the upside last month as pre-Christmas sales tempted shoppers on to the High St. We will see whether that trend has continued or whether the demand was simply poached from months further down the line. We also receive Eurozone retail sales at 10.00 and US ISM at 15.00.

Fundamentals are all well and good but are about as permanent as a rainbow at the moment and the focus will remain on Europe.

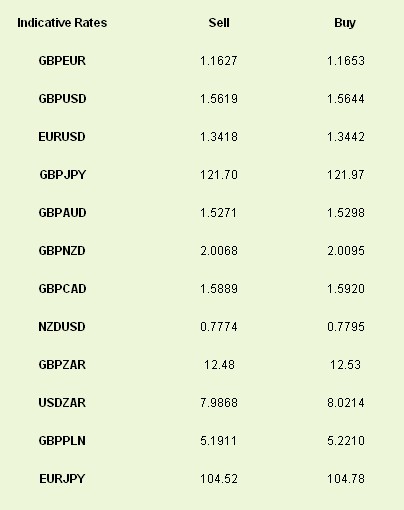

Latest

exchange rates at time of writing