Last Friday Democrats and Republicans were still at loggerheads, while a series of cuts in budgetary expenditure began on March 1. These cuts should mainly affect the American defense while total cuts will represent $85 billion. The International Monetary Fund believes that if they persist until fall, it could cause a 0.5% slowdown to the country’s growth. By March 27, the U.S. Congress will vote on a minimal budget to ensure the functioning of the state. We can therefore anticipate an escalation of political tensions. Last week, the euro had it difficult as it dropped below 1.30. The main reason for this decline comes from the results of Italy's election, suggesting instability for the coming year.

The Loonie

“If one does not know to which port one is sailing, no wind is favorable.” Lucius Annaeus Seneca

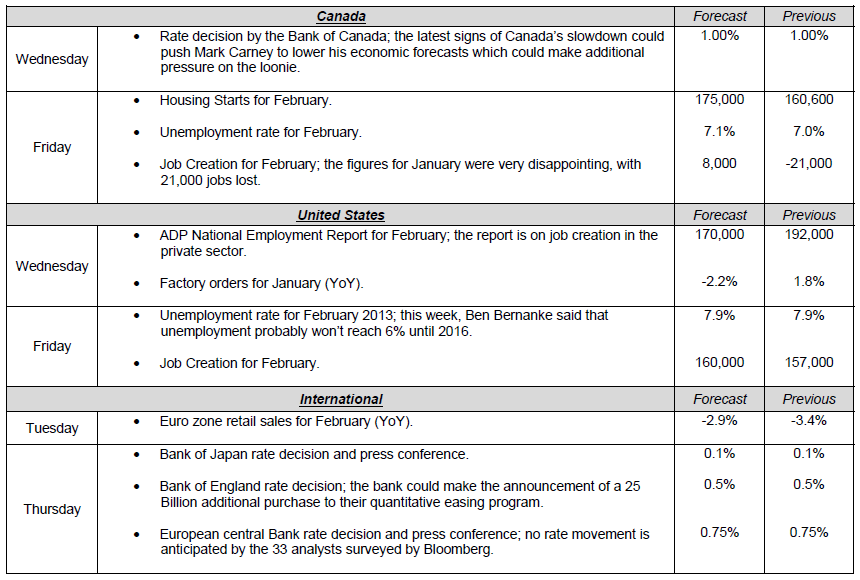

On Friday, statistics were released on Canada’s GDP for the fourth quarter of 2012. Even though the published figure confirmed economists’ expectations, allowing the Canadian dollar to rise several basis points against the greenback, the figure was disappointing nonetheless. The Canadian economy grew at an anemic 0.6% in the final quarter of 2012 in annualized terms, following 0.7% growth in the third quarter. As shown by the graph below, this was the weakest growth since 2011 when the economy shrank 0.8%, primarily due to the impact of the tsunami in Japan that year. Setting aside this atypical event, the last time growth was this poor was during the 2008-2009 recession. The year ended in a whimper for Canada, with manufacturing sales, international securities transactions, and wholesale and retail sales all falling far short of economists’ forecasts. After holding its own through all the turmoil, our economy is finally falling victim to slow growth in the U.S., our largest trading partner.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Italian Instability, DNC And GOP At Loggerheads

Published 03/05/2013, 06:42 AM

Updated 05/14/2017, 06:45 AM

Italian Instability, DNC And GOP At Loggerheads

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.