Market movers today

In terms of economic data releases, it is another quiet day today. In the UK, the monthly GPD indicator for June (and hence the full estimate of Q2 GDP) is released at 10.30 CEST, which is expected to show that GDP growth has slowed in Q2 compared to Q1, as the original Brexit stockpiling effect is no longer artificially boosting GDP growth.

In the Scandies, we have a couple of interesting releases. In Sweden, we could see a rebound in the household consumption indicator for June, given the fact that retail sales rebounded sharply. In Norway, we expect a further slowdown in core inflation to 2.2% in July. For more see overleaf.

Selected market news

The coherence of the governing Italian coalition of League/Five Star went from bad to worse yesterday evening, as Salvini followed up on recent days' comments and called for a parliamentary vote of confidence, which, if resulting in Prime Minister Giuseppe Conte losing the ballot, could lead to swift elections to be held already in October. Based on opinion polls, Salvini and the League would be set for almost 40% of the popular vote, whereas the Five Star movement has plummeted in polls to just above 15% down from 32% at the general elections in March 2018. However, Salvini cannot himself summon the parliament, which is currently in recess, and even if Conte loses the ballot, it will be the president deciding whether new general elections will be held, or instead trying to arrange for an alternative governing coalition. Salvini's comments put BTPs under pressure already yesterday and we expect more of the same today, even though the Salvini announcement actually removes uncertainty from the market.

Japanese GDP figures covering Q2 showed that the economy grew at an annualised rate of 1.8% compared to Bloomberg consensus of just 0.5%. Q1 growth figures were also revised up to 2.8% from 2.2%. Net exports fell for a seventh straight month, as private consumption and investments have kept the economy on course this year. However, the outlook for private spending is gloomy due to a sales tax hike taking effect from October, and given that no solution seems in sight regarding the trade war (see US-China Trade: Three trade war scenarios - 'no deal' now our baseline ), GDP forecasts for 2019 are at just 0.7%.

The Bank of Japan has addressed the excessive curve flattening (2y10y close to zero) by moving its asset purchases into shorter maturities and by doing so hopes to halt the appreciation of the yen.

US stocks rallied from the open on the back of the positive trade figures out of China last night - S&P was up 1.6%. The risk-on sentiment was further confirmed with the 30Y Treasury bond auction slightly weaker than expected and 10Y yields subsequently up 8bp. The yield moves were reversed during the afternoon following the news from Italy and trade war tensions: US 10Y yields closed 1.7bp lower, while stocks extended gains.

Scandi markets

In Norway, core inflation has slowed for the past three months due to base effects, but it was still above the 2%-target at 2.4% y/y in June. As food prices pushed up core inflation more than usual in July last year, we expect a further slowdown to 2.2% in July. That would be somewhat lower than estimated by Norges Bank in June (2.4%).

In Sweden today we could see a rebound in the household consumption indicator for June, given the fact that retail sales bounced sharply (there is a fairly strong, although not perfect, y/y correlation between the two). This figure feeds into the Q2 GDP estimates, where - somewhat surprisingly - household consumption was the only factor that added positively to growth q/q in the preliminary release.

Fixed income markets

Bunds came under temporary pressure and the German curve steepened 10-30y, as Reuters broke a story that the German government is ready to make a fiscal U-turn and break the budget rule and spend money on climate measures. However, the German Finance Ministry rejected the story later in the day and we also note that the German mainstream media did not mention anything in the evening news. Bottom-line is that significant fiscal easing in Germany is probably not imminent. However, the news gave us some important insight into market sentiment. The sudden move higher in yields and steepening of the curve indicate that the market is now sensitive to ‘yields up’ news and that Bund positioning might be stretched. 10y Bunds ended the day a modest 2bp higher at -0.56%.

Italy is up for review by Fitch tonight (BBB/negative). Given the political and economic outlook, the risk of a downgrade is not trivial. However, given the significant drop in Italian funding costs, we stick to the view that rating and outlook will be kept unchanged once again.

Portugal is up for review by Moody’s (Baa3/stable). Given the economic performance, lower funding costs and lower debt-to-GDP than expected a ‘positive outlook’ is likely and even an outright upgrade is possible. See also Government Bonds Weekly. Finally, we published our Yield Outlook last night. We have a 3M (NYSE:MMM) target for 10Y Bunds at -0.70%.

FX markets

A sudden headline suggesting that Germany could be contemplating fiscal easing briefly shook FX markets yesterday. EUR shot higher across the board on the back of a move higher in German yields, but the market quickly reversed the move as the story lacked firm details. Nevertheless, the story is out there and will be one to watch over the coming weeks.

In general, FX markets are stabilising after negative risk sentiment has set the tone since last week’s FOMC meeting notably with a stronger JPY and weaker Scandies. While it is difficult to see what could trigger a rebound in the short term, it would likely take more bad news, e.g. further escalation of trade tensions and/or deterioration in global macro data to extend risk-off trades further.

More specifically, EUR/NOK close to 10.00 level continues to attract attention. While it is an extreme high level from a historical perspective, it is not necessarily a high level measured against the current global headwinds. Hence, the oil price measured in NOK terms is now at the lowest level since the beginning of the year, down 10% the past week and 20% since the peak in April, i.e. the NOK might have weakened significantly, but not enough to keep pace with oil falling into bear market.

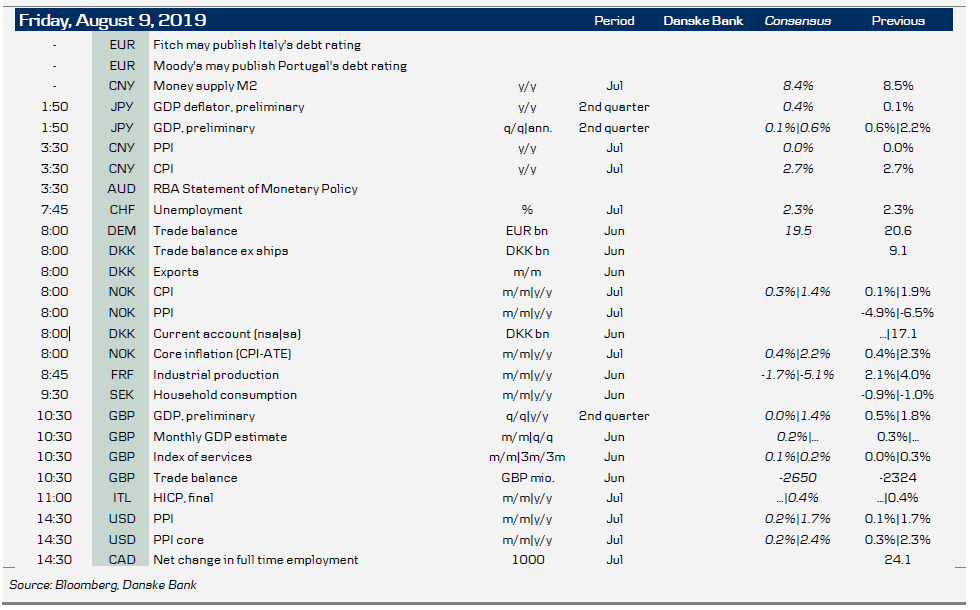

Key figures and events