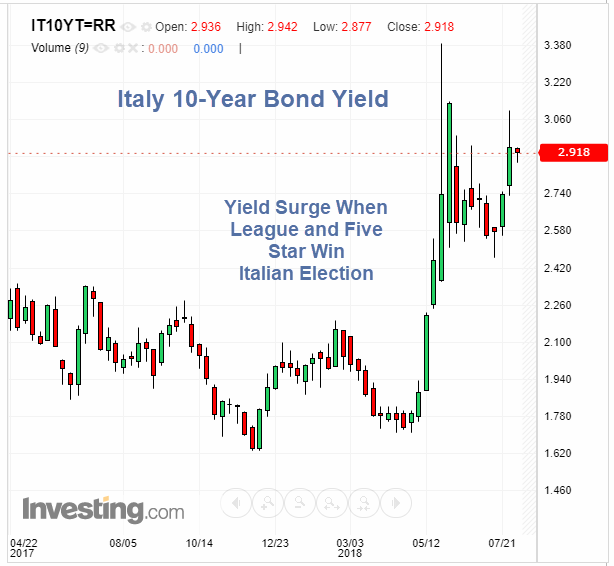

Italy's 10-Year bond yield surged around the Italian election. There's heavy issuance in Sept and ECB tapering in Oct.

The yield on Italian bonds surged in May on the victory of the League- and Five Star in the national election. The alliance does not intend to follow EU budget rules.

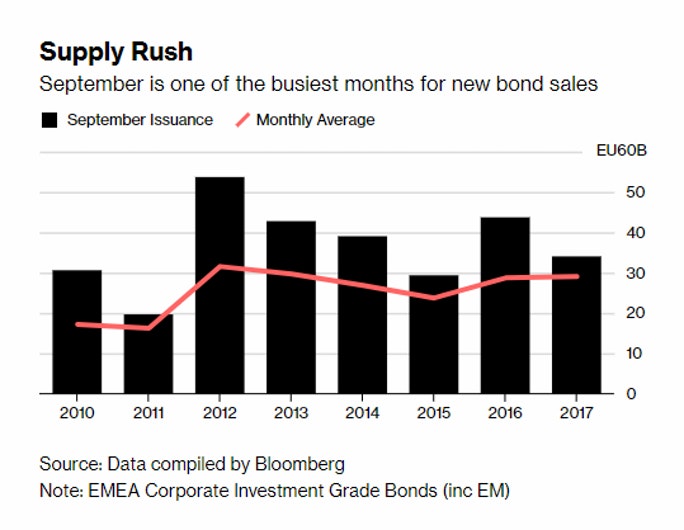

Heavy issuance is coming up in September. And in October, the ECB is scheduled to taper its QE bond purchases. This Combination of Events May Derail the Italian Bond Market.

Bankers lining up new company bonds in September may find that budget and spending discussions in Italy could derail what’s usually the second-half’s busiest issuance month. That’s what happened in May, another typically busy month for sales, when the Italian election result triggered a government bond sell-off and issuance slump.

“If we have something that resembles what we saw in May, the primary market should basically come to a halt,” said Marco Stoeckle, a credit strategist at Commerzbank AG (DE:CBKG). “If we have the Italian government curve inverting, anything like that would be enough to significantly hamper issuance volumes. I guess the market would be closed.”

Last week, as Italian finance minister Giovanni Tria was said to begin a series of meetings to determine a draft budget, there were already signs of nerves, with 10-year yields breaking above three percent for the first time in nearly two months. Markets fear the nation may be headed for a collision course with European Union partners as the two parties in Italy’s ruling coalition pledge to implement bold spending plans next year.

On May 29, as BTP spreads lurched violently, borrowing costs for all of Europe’s corporate borrowers rose: the Bloomberg Barclays index of corporate spreads widened 100 basis points in a single day -- its largest jump in almost two years.

Even without Italy, the credit market’s already pretty fragile as it prepares for the potential withdrawal of one of its biggest investors, the European Central Bank, which is due to cut its bond-buying program to 15 billion euros a month in October and then end purchases in December. President Trump’s trade spat with China also isn’t helping calm nerves.

Italian 10-Year Bond Yields

Italy 10 Year vs Germany 10 Year Spread

Spread Movements

- On May 2, the spread between Italian 10-year government bonds and German 10-year government bonds was 120 basis points

(1.2 percentage points). - After the election, the spread surged as high as 311 basis points.

- The spread is currently 251 basis points.

Default Risk

According to the ECB, there is zero risk of default on any EMU (Eurozone) government bonds. If the market agreed, there would be no spread.