The euro dropped to a fresh two-year low against the US dollar yesterday, following a disappointing Italian bond auction which led to fears that the euro-zone debt crisis is spreading to other countries in the region. In addition, fears regarding the health of the Spanish banking sector caused other higher yielding currencies and commodities to extend their bearish trends throughout the day. Today, traders will want to pay attention to a batch of US data, including the ADP Non-Farm Employment Change and Prelim GDP figures. Any better than expected news could help the dollar add onto its recent gains.

Economic News

USD - ADP Non-Farm Figure Set to Create Dollar Volatility

The US dollar saw additional gains against riskier currencies like the euro and AUD yesterday, as investors continued to shift their funds to safe-haven assets amid concerns regarding the Spanish banking sector. The EUR/USD fell close to 80 pips during European trading, reaching as low as 1.2406 before staging a very slight upward correction. A worse than expected Australian Retail Sales figure caused the AUD/USD to fall well over 100 pips over the course of the day. After reaching as low as 0.9724, the pair was able to reverse upwards and stabilize around the 0.9740 level.

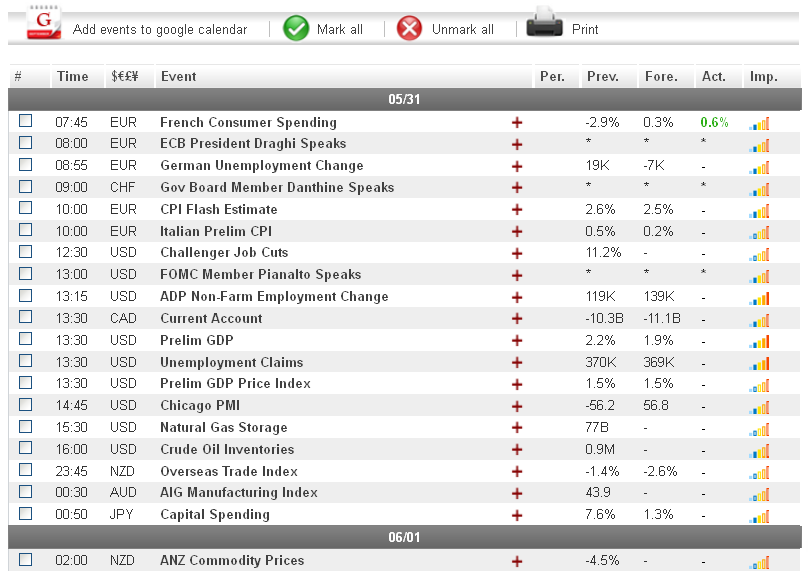

Turning to today, traders will want to pay attention to a batch of US data, including the ADP Non-Farm Employment Change and Prelim GDP figures. The ADP statistic is considered an accurate predictor of Friday's all-important Non-Farm Payrolls figure, and consistently leads to market volatility. A better than expected figure could help the dollar recover some of its recent losses against the JPY. With regards to the Prelim GDP, analysts are forecasting that the figure dropped from last quarter. If true, investors may take it as a sign that the US economic recovery is weakening, which could cause the dollar to fall against its safe-haven currency rivals.

EUR - Spanish, Italian News Send EUR to Fresh Lows

Ongoing fears regarding Spain's banking sector combined with a disappointing Italian bond auction, caused the euro to tumble against several of its main currency rivals yesterday. In addition to the 80 pip drop the common currency took against the US dollar, the EUR/JPY also fell around 125 pips during European trading. The pair dropped as low as 97.91, a four-month low. That being said, the news was not all bad for the euro, which was able to move up against the AUD, following a disappointing Australian retail sales figure. The EUR/AUD reached as high as 1.2761, up over 60 pips for the day.

Turning to today, euro traders will want to monitor the results of the Irish Stability Treaty Vote. Ireland is holding a referendum on whether to accept or reject the EU Stability Treaty. Most analysts are forecasting that the referendum will pass, which if true, may give the euro a boost during mid-day trading. That being said, should Ireland vote no on the treaty, it will likely lead to additional euro-zone fears, which could result in the common-currency dropping to new lows against the USD and JPY.

JPY - Yen Continues to Benefit from Risk Aversion

Risk aversion due to euro-zone worries and worse than expected US data led to significant gains for the safe-haven Japanese yen yesterday. The USD/JPY fell as low as 78.86, down over 60 pips for the day, amid fears that the US economic recovery is slowing down. Against the AUD, the yen was able to benefit from poor Australian retail sales data. The AUD/JPY fell over 100 pips, reaching as low as $76.70.

Turning to today, traders will want to pay attention to US news, specifically the ADP Non-Farm Payrolls figure at 12:15 GMT. Should the figure come in above the forecasted 145K, the yen could reverse some of its recent gains during the afternoon session. That being said, if the figure comes in below expectations, the JPY could extend its recent bullish trend.

Crude Oil - Risk Aversion Sends Crude Oil Tumbling

The combination of euro-zone debt worries and disappointing US data sent the price of crude oil tumbling during the European session yesterday. Investor fears regarding declining demand for oil in the US was reinforced following a significantly worse than expected Pending Home Sales figure. Overall, the price of crude dropped over $2 a barrel, eventually reaching as low as $88.16.

Turning to today, oil traders will want to pay attention to the US Crude Oil Inventories figure, scheduled for 15:00 GMT. Record high crude inventories in the US have been taken as a sign of decreased demand in the world's largest oil consuming country. Should today's figure come in the above expected level of 0.2M, oil could drop further as a result.

Technical News

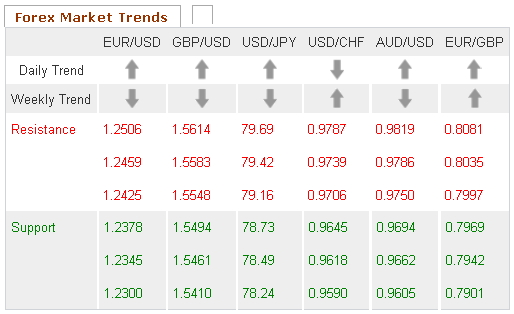

EUR/USD

A bullish cross on the daily chart's Slow Stochastic indicates that this pair could see an upward correction in the near future. This theory is supported by the weekly chart's Williams Percent Range, which has dropped into oversold territory. Opening long positions may be the wise choice for this pair.

GBP/USD

Long-term technical indicators are providing mixed signals for this pair. On the one hand, the weekly chart's MACD/OsMA has formed a bearish cross, meaning downward movement could occur in the coming days. That being said, the same chart's Williams Percent Range has dropped into oversold territory. Taking a wait-and-see approach may be the wise choice for this pair.

USD/JPY

While the Williams Percent Range on the weekly chart has dropped into oversold territory, most other technical indicators show this pair trading in neutral territory. Traders may want to take a wait-and-see approach, as a clearer picture is likely to present itself in the coming days.

USD/CHF

The Relative Strength Index on the daily chart has crossed over into the overbought zone, indicating that this pair could see downward movement in the near future. Furthermore, the weekly chart's MACD/OsMA has formed a bearish cross. Opening short positions may be the right move for this pair.

The Wild Card

USD/HUF

Both the Slow Stochastic and the MACD/OsMA on the daily chart have formed bearish crosses, indicating that this pair could see downward movement in the near future. This theory is supported by the Relative Strength Index on the same chart, which is currently in overbought territory. This may be a good opportunity for forex traders to open short positions ahead of a possible downward correction.

Economic News

USD - ADP Non-Farm Figure Set to Create Dollar Volatility

The US dollar saw additional gains against riskier currencies like the euro and AUD yesterday, as investors continued to shift their funds to safe-haven assets amid concerns regarding the Spanish banking sector. The EUR/USD fell close to 80 pips during European trading, reaching as low as 1.2406 before staging a very slight upward correction. A worse than expected Australian Retail Sales figure caused the AUD/USD to fall well over 100 pips over the course of the day. After reaching as low as 0.9724, the pair was able to reverse upwards and stabilize around the 0.9740 level.

Turning to today, traders will want to pay attention to a batch of US data, including the ADP Non-Farm Employment Change and Prelim GDP figures. The ADP statistic is considered an accurate predictor of Friday's all-important Non-Farm Payrolls figure, and consistently leads to market volatility. A better than expected figure could help the dollar recover some of its recent losses against the JPY. With regards to the Prelim GDP, analysts are forecasting that the figure dropped from last quarter. If true, investors may take it as a sign that the US economic recovery is weakening, which could cause the dollar to fall against its safe-haven currency rivals.

EUR - Spanish, Italian News Send EUR to Fresh Lows

Ongoing fears regarding Spain's banking sector combined with a disappointing Italian bond auction, caused the euro to tumble against several of its main currency rivals yesterday. In addition to the 80 pip drop the common currency took against the US dollar, the EUR/JPY also fell around 125 pips during European trading. The pair dropped as low as 97.91, a four-month low. That being said, the news was not all bad for the euro, which was able to move up against the AUD, following a disappointing Australian retail sales figure. The EUR/AUD reached as high as 1.2761, up over 60 pips for the day.

Turning to today, euro traders will want to monitor the results of the Irish Stability Treaty Vote. Ireland is holding a referendum on whether to accept or reject the EU Stability Treaty. Most analysts are forecasting that the referendum will pass, which if true, may give the euro a boost during mid-day trading. That being said, should Ireland vote no on the treaty, it will likely lead to additional euro-zone fears, which could result in the common-currency dropping to new lows against the USD and JPY.

JPY - Yen Continues to Benefit from Risk Aversion

Risk aversion due to euro-zone worries and worse than expected US data led to significant gains for the safe-haven Japanese yen yesterday. The USD/JPY fell as low as 78.86, down over 60 pips for the day, amid fears that the US economic recovery is slowing down. Against the AUD, the yen was able to benefit from poor Australian retail sales data. The AUD/JPY fell over 100 pips, reaching as low as $76.70.

Turning to today, traders will want to pay attention to US news, specifically the ADP Non-Farm Payrolls figure at 12:15 GMT. Should the figure come in above the forecasted 145K, the yen could reverse some of its recent gains during the afternoon session. That being said, if the figure comes in below expectations, the JPY could extend its recent bullish trend.

Crude Oil - Risk Aversion Sends Crude Oil Tumbling

The combination of euro-zone debt worries and disappointing US data sent the price of crude oil tumbling during the European session yesterday. Investor fears regarding declining demand for oil in the US was reinforced following a significantly worse than expected Pending Home Sales figure. Overall, the price of crude dropped over $2 a barrel, eventually reaching as low as $88.16.

Turning to today, oil traders will want to pay attention to the US Crude Oil Inventories figure, scheduled for 15:00 GMT. Record high crude inventories in the US have been taken as a sign of decreased demand in the world's largest oil consuming country. Should today's figure come in the above expected level of 0.2M, oil could drop further as a result.

Technical News

EUR/USD

A bullish cross on the daily chart's Slow Stochastic indicates that this pair could see an upward correction in the near future. This theory is supported by the weekly chart's Williams Percent Range, which has dropped into oversold territory. Opening long positions may be the wise choice for this pair.

GBP/USD

Long-term technical indicators are providing mixed signals for this pair. On the one hand, the weekly chart's MACD/OsMA has formed a bearish cross, meaning downward movement could occur in the coming days. That being said, the same chart's Williams Percent Range has dropped into oversold territory. Taking a wait-and-see approach may be the wise choice for this pair.

USD/JPY

While the Williams Percent Range on the weekly chart has dropped into oversold territory, most other technical indicators show this pair trading in neutral territory. Traders may want to take a wait-and-see approach, as a clearer picture is likely to present itself in the coming days.

USD/CHF

The Relative Strength Index on the daily chart has crossed over into the overbought zone, indicating that this pair could see downward movement in the near future. Furthermore, the weekly chart's MACD/OsMA has formed a bearish cross. Opening short positions may be the right move for this pair.

The Wild Card

USD/HUF

Both the Slow Stochastic and the MACD/OsMA on the daily chart have formed bearish crosses, indicating that this pair could see downward movement in the near future. This theory is supported by the Relative Strength Index on the same chart, which is currently in overbought territory. This may be a good opportunity for forex traders to open short positions ahead of a possible downward correction.