Despite making a run for this year’s high, price action has left warning signs that it is getting tough at the top.

Some charts are prettier than others, whilst others are too difficult to read. That has mostly been the case for the EUR/GBP weekly chart over the past 10 months which has been entrapped within a rough n’ ready sideways oscillation. In recent weeks it has managed to rise to its highest level since March, yet due to a series of resistance levels overhead and warning signs on the daily chart, it’s possible the move higher may be running out of steam.

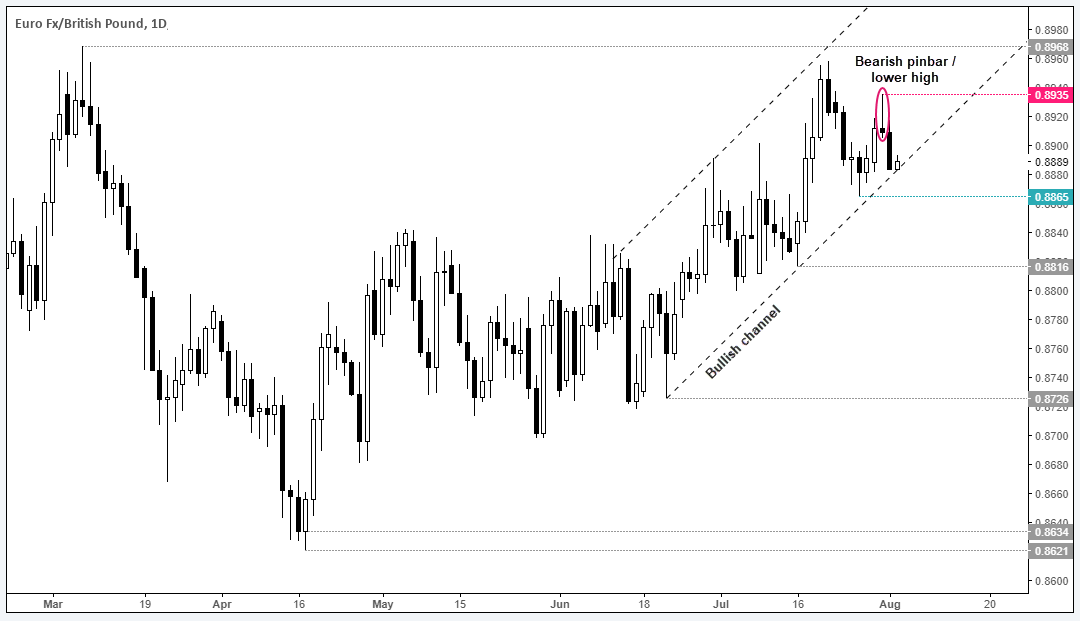

The bullish channel on the daily chart has shown signs of promise, but the dark cloud cover reversal pattern which failed to test the March high sent a warning to the bull camp. Admittedly it’s not often you see a structural level of resistance (or support) break on its first attempt, but a lower high has now formed with a bearish pinbar and price action is resting precariously on the lower trendline. Unless EUR/GBP can pull its socks up, EUR/GBP could be gearing up towards a break lower.

That said, with the BOE meeting in just a few hours volatility can be expected, with an initial move in either direction. Yet a trendline break would be constructively bearish and keep the cross in its long-term range.