With Fed minutes, Powell’s testimony and a BoC meeting, it should make for a lively session for traders, with USD/CAD finding itself caught in the crossfire.

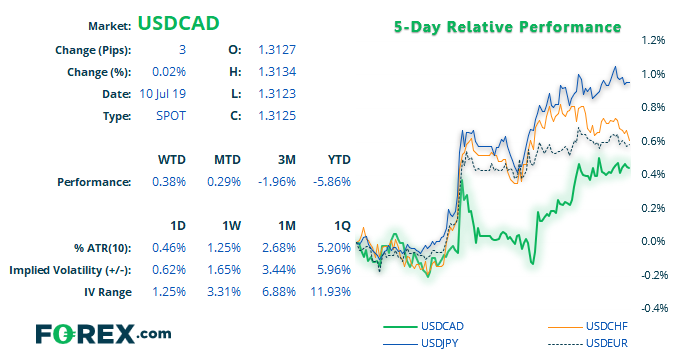

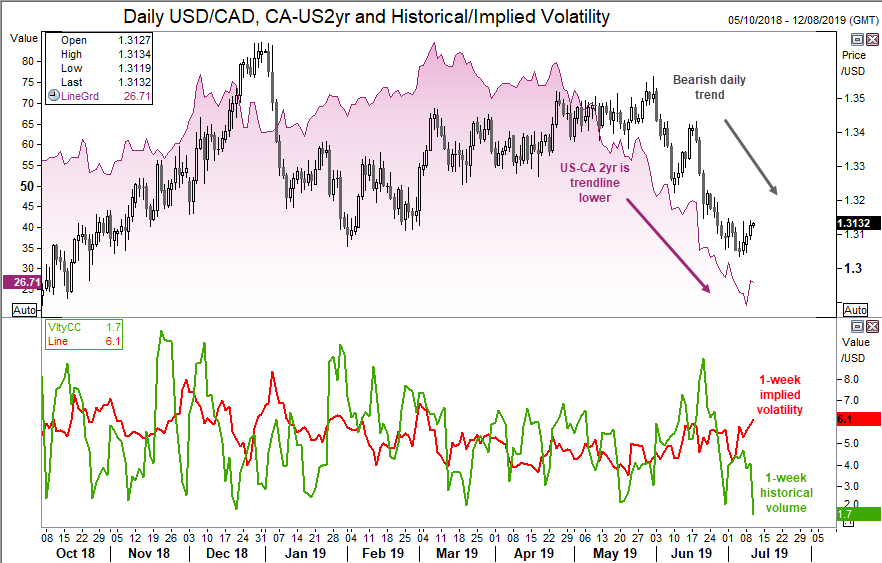

Starting with volatility (lower panel) we can see that 1-week historical volatility has dropped as markets await this key date. However, implied 1-week volatility has also risen to show markets do not expect volatility to remain low. Given there are so many moving parts over the next 12 hours between the Fed and BOC, it would be advisable to step aside until a clearer picture emerges from the occasion. Yet what we’re looking for is a clear diversion between the Fed and BOC, which could allow us to expect a sustained bullish or bearish move.

The daily chart remains in a clear downtrend, and yield differentials (US-CA2 year) also with a bearish trend as prices are closely tracking them. However, prices are retracing from their lows since failing to hold below our initial target around the February 2019 low and we could see this push higher if Powell is less dovish and/or BoC are more hawkish than expected. Regardless, we retain our core bearish view for USD/CAD but it still leaves room for a deeper retracement before heading lower once more.

The four-hour chart shows a potential reversal pattern which could be part of the daily correction. It’s hard to call it a textbook reversal pattern, but price action is reminiscent of either an inverted head and shoulders pattern, or perhaps a double/triple bottom.

- 1.3145 is a pivotal level over the near-term

- A clear break above 1.3145 could signal further upside within the bearish channel

- Counter-trend bulls could target the upper channel and / or the resistance cluster around 1.3225/50 (or bears could look for opportunity to re-enter short if bearish momentum returns around these levels).

- A rejection of 1.3145 is favourable to the bear-camp and signals a return to its bearish, daily trend.

- A break of 1.031 signals further downside on the daily trend in line with our core, bearish view.