You can ignore reality, but you can’t ignore the consequences of ignoring reality

- Ayn Rand

The title quote references the conversation I mentioned a couple weeks ago with a local businessman who knows a retired military General with ties deep into the Pentagon. The reference is to the U.S. economic and political system, not the condition of the Dept. of Defense.

While the Obama regime and the elitist-controlled media seem to never fatigue from telling us that the economy is recovering, the data suggest otherwise. My latest and freshest data point is the National Retail Federation's estimate that retail sales fell 3% over the 4-day holiday weekend this year. What's remarkable, if not outright stunning, about that is the fact that this year it was truly 4 days of sales, as many big retailers opened on Thanksgiving. Given the heavy degree of discounting, and the pervasive ad campaigns advertising the deals, I don't know how you can conclude anything but that the consumer is tapped out.

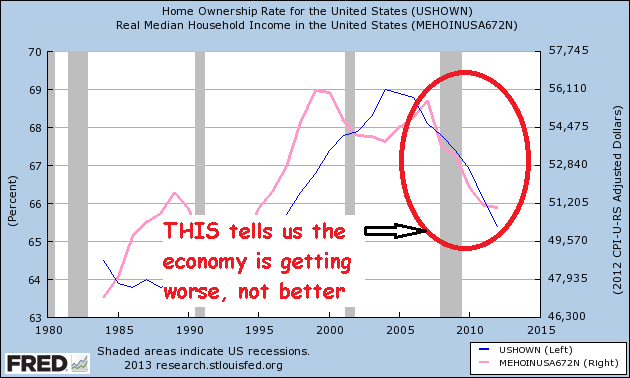

But let's take a look at two more data points that come from the website of the Federal Reserve. This first graph shows a plot of real median income and the home ownership rate in the U.S (sourced from Confounded Interest blog, edits in red are mine):

How can the economy possibly be improving when household income adjusted for the Government's low-ball inflation bogey is rapidly declining. Moreover, despite the heavy advertisements of a housing recovery, the rate of home ownership is in steep decline. Yes, I know housing prices are going crazy, supposedly, but this is largely due to a big surge in "investment" buying that has dropped off rapidly over the past few months.

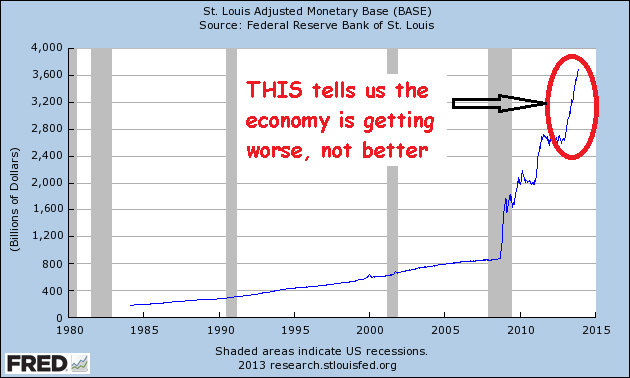

This second chart shows the rate at which the Fed is printing money - please note that the rate of increase is accelerating despite the debate over what and when "taper" means (sourced from St. Louis Fed website, edits in red are mine):

What's most interesting about this is that almost none of that money is going beyond the big bank balance sheets in the form of "excess reserves" being held at the Fed. Now, why is the Fed printing over $85 billion per month now only to have it sit collecting interesting by our Too Big To Fail banks?

Circling back to my quote from Ayn Rand at the top, most people with whom I discuss the economy/system with are either unaware of just how bad things are getting or they may know but choose to bury their head in the sand and ignore it. But just because we collectively as a society choose to not look at a problem or pretend it's not there doesn't mean it will go away. In fact, based on everything I look at, except for maybe sales of high end sports cars, expensive jewelry and rare art, our system is crumbling quickly. I am willing to bet that 2014 ushers in an era of severe economic pain and Government control over our lives. Those charts above tell me I'm probably right.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Is The Economy Really recovering? Data Suggests No

Published 12/03/2013, 12:57 AM

Updated 08/21/2024, 03:35 AM

Is The Economy Really recovering? Data Suggests No

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.