One of the conditions of the financial assistance package for Cyprus was a promise to shrink its banking sector to the ``European norm`` by 2018. For those of us who are beyond tired of financial crises being triggered by banks (where money is supposed to be safe), it seems like a long-overdue prescription.

But dig a little deeper. The country`s economy is service-based: banking, accounting, law, investment advisory and tourism are the main industries (kind of like parts of Manhattan). No steel mills. No car plants. No high-tech manufacturing. Shrinking the financial services sector means shrinking the economy and laying off tens of thousands of ordinary middle-class people. Will they all find jobs in the not-yet-existing-but-soon-to-be-created steel mills, car plants and high-tech manufacturing facilities? Or maybe they will just have to emigrate to other parts of the EU.

Of course, the situation in Cyprus is the result of the situation in Greece. Banks in Cyprus bought Greek government bonds, which were then discounted as part of the Greek bailout. Having lent their customers` money to Greece, (and unable to get it all back), they were unable to repay all of their depositors. Kind of like the S&L crisis in the early 90`s, when all of those bad real estate loans and mortgages led to thousands of S&L failures.

Mortgage loans and government bonds – the two things that bank regulators and securities regulators think are the most secure end up being the trigger for yet another financial crisis.

What doesn`t seem to trigger a financial crisis, a bank run, or black swan event is the ongoing operating profits of the 45,000 companies trading on stock markets around the world.

More than a few ticker-watchers cheered as the S&P broke through its all-time high at the end of March – but we heard fewer people commenting on the fact that the all-time high for corporate earnings of $104.60[1] was also in March. In fact, earnings broke through their pre-financial crisis peak of $88/share almost two years ago.

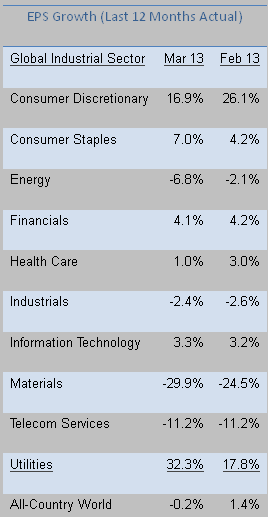

Earnings momentum has softened overall; the contrast between industrial sectors is significant.

Funny how you don’t hear a lot about zero percent earnings growth (yet). Globally, earnings are 20% lower than analysts forecasted last year – US equities did better – missing their targets by only 3%. But look again at the divergence between those industrial sectors – overall flat growth is the result of double-digit gains by some and double-digit losses by others.

We expect the upcoming earnings season might be a little bumpy. That, combined with anxiety over European banks will probably end the rally in US stocks. A sharp correction is unlikely – there is still a lot of money on the sidelines – but entering a trading range is a very likely possibility.

There are still a lot of opportunities. We’re continuing to find sectors with rising earnings, upwards revisions in earnings estimates, and reasonable valuations.

It’s not all doom and gloom.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

It's Not All Doom And Gloom

Published 04/04/2013, 07:56 AM

Updated 07/09/2023, 06:31 AM

It's Not All Doom And Gloom

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.