The Bank of Japan raised its growth outlook, keeping monetary policy unchanged at its latest meeting. In the latest to be swept up in “reflation”, Japan’s central bank even trumpeted (pardon the pun) the expected Trump “stimulus” as a reason to be more optimistic. Why wouldn’t they? After all, there is no place on Earth that more appreciates government spending than that island nation. Appreciating what it actually achieves, however, is altogether different.

The Bank of Japan forecast an era of surging economic growth and kept monetary policy on hold on Tuesday following a Donald Trump-induced slide in the yen.

Japan’s central bank predicted the economy would grow significantly faster than its long-run trend to March 2019 based on easy monetary policy, government fiscal stimulus and a pick-up in growth overseas.

If it seems like we have been here before with Japan, minus the Trump, it is because we have. It is something of a regular feature in Bank of Japan communications where they upgrade their outlook using nearly identical and uniform language, only to be surprised later when that outlook fails often spectacularly. The last time the Japanese were so optimistic was late 2013, when BoJ then did as they have today. Board Member Sayuri Shirai told an audience Tokushima in late November 2013:

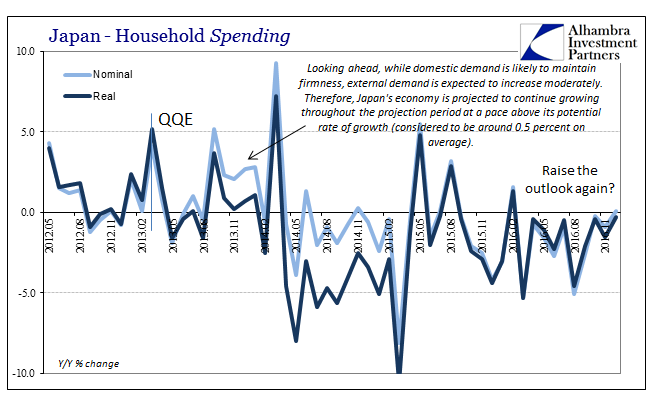

Looking ahead, while domestic demand is likely to maintain firmness, external demand is expected to increase moderately. Therefore, Japan’s economy is projected to continue growing throughout the projection period at a pace above its potential rate of growth (considered to be around 0.5 percent on average). The projection would remain unchanged even if the economy were affected by the front-loaded increase and subsequent decline in demand prior to and after the two scheduled consumption tax hikes, in April 2014 and October 2015.

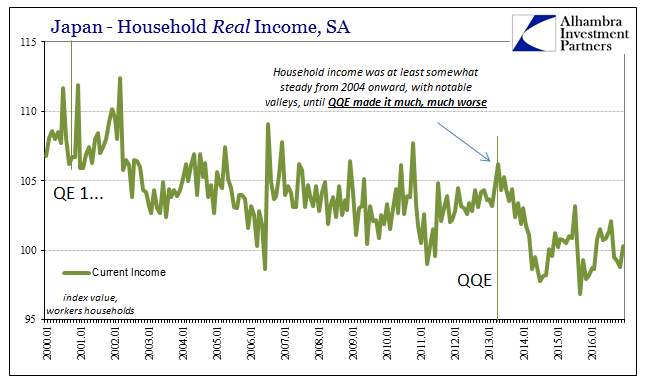

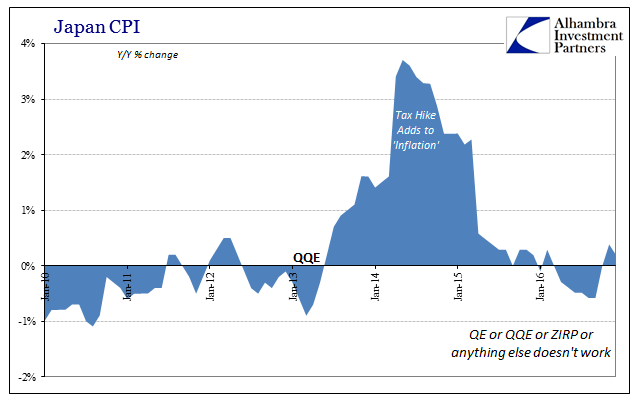

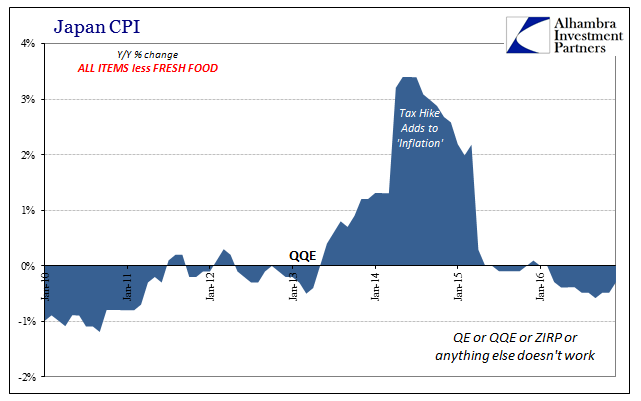

As we know, that never happened and not even close. The reason for that is all the reasons the Bank of Japan (or economists in general) never seems able to comprehend. There is the monetary system as it actually is, rather than the theory of bank reserves disproven in Japan longer and farther than anywhere else, as well as the absurdity of trying to create a recovery and sustainable growth from out of large and imposing negative factors. Currency instability is not an economic cure, it is an economic curse.

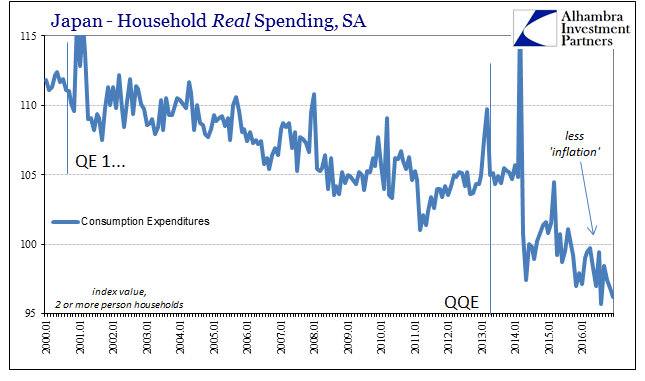

Household spending in Japan continued to decline throughout 2016 worse than it had in 2015. Nominal spending was barely positive in December for only the second time last year.

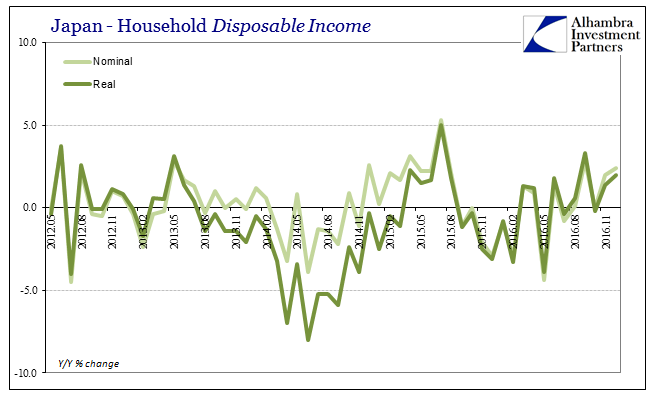

Disposable Household Income has turned positive again, but that is misleading. Like in so many other economies around the world, the Japanese people suffer from monetary policy and then never recover from it. What you see above is the typical positive numbers that don’t come anywhere close to erasing the intermittent declines “unexpectedly” imposed on them. This pattern of impoverishment is perfectly clear, however, in the long run context.

If anything, the Bank of Japan may want to downgrade its economic forecast based on the behavior of the Japanese economy in the recent past rather than upgrade it based on theoretical models that never change despite all evidence contrary to them. Inflation ticked positive again at the end of 2016 with the yen falling and oil prices rising, which, if the last few years is an indication, is a bad sign for the Japanese economy no matter how many times the central bank claims that is what it wants.

Fortunately for the Japanese people, the yen in January has reversed again, with it today back above 113, up from around 117 to start the year. That signals, especially with the Chinese off to holiday this week, a pause in “reflation” hopes that really should have been extended to official forecasts.

In fact, no “reflation” iteration is complete without the myriad often large upgrades to economic forecasts. These happen, of course, without much or any of an economic basis, simply because the official stance remains that if any particular economy isn’t right at this moment getting worse it must be getting better (transitory is not just a word for Janet Yellen to use). Nowhere has that assumption been proven so false as Japan. It was after 2013, and nothing has changed in the years since. The only meaningful difference of note is that QQE is no longer really mentioned, which tells us more about the economic abilities of central bankers than it says about the expected “accommodation” from it quietly continuing.