Investing.com’s stocks of the week

So here's a nice quote from the Chicago Federal Reserve Senior Economist , Mr. Francois Velde...

"it is hard to imagine a world where the main currency is based on an extremely complex code understood by only a few and controlled by even fewer, without accountability, arbitration, or recourse."

Of course, he was talking about bitcoin when he said it but many people in the Internet community heard a concise description of the current monetary system, which is held in place by the Federal Reserve and other central banks, the very same institution that Mr. Velde currently serves.

Today's Highlights

Trump: Putting out Fires

What caused the Crypto Sell-off?

What could drive the next surge?

Please note: All data, figures & graphs are valid as of January 9th. All trading carries risk. Only risk capital you can afford to lose.

Backdrop

For the first time in two years, leaders of North and South Korea got together and had a meaningful discussion. The main result was that the DPRK will likely be sending a team of Olympians to the Winter Games in Pyeongchang next month.

No doubt the President of the United States will be taking at least some of the credit for this groundbreaking change in relationship status, as he has with the soaring stock market, and the roaring economy.

Somehow, I'm pretty Ok with that though. After the fires he's been putting out lately with the new book "Fire & Fury" and Special Investigator Robert Mueller hot on his heels, the man deserves a win.

Ironic as it may seem, the new tax incentives have in fact improved the outlook for businesses in the USA, even if they are derived from borrowed money. And it is possible that comparing button sizes with Kim Jong Un was exactly what was needed to get the job done.

Crypto Sell Off

A massive sell-off gripped the crypto markets yesterday afternoon. What caused it?

An unannounced data adjustment by coinmarketcap.com. CMC is probably the biggest website in the world of crypto. I myself have included their information in these daily updates many times and according to the Wall Street Journal, the website is ranked in the same ballpark as Alibaba (NYSE:BABA).

It seems the decision was taken to exclude data coming from the South Korean exchanges. As we've noted several times, the pricing on cryptocurrencies like Bitcoin and Ripple is frequently up to 25% higher in South Korea than it is in the rest of the world. So it seems the CMC felt that their data was being offset by this outlier.

The result of this sudden change appeared to many traders to be a sudden drop in the price without any real reason for it, which in turn prompted an onslaught of panic selling.

The biggest and most noticeable drop was Ripple, which was already extremely inflated over the past few weeks and was due for a major correction. But the selling soon spread to the entire crypto-market. Only Ethereum stood out as a safe haven and managed to stay positive throughout the day.

The good news is that because people figured out pretty quickly that the sell-off was due to a fluke, the prices rebounded pretty quickly. The not so great news is that these sudden movements do seem to be sparking further volatility in the market as well as other side effects.

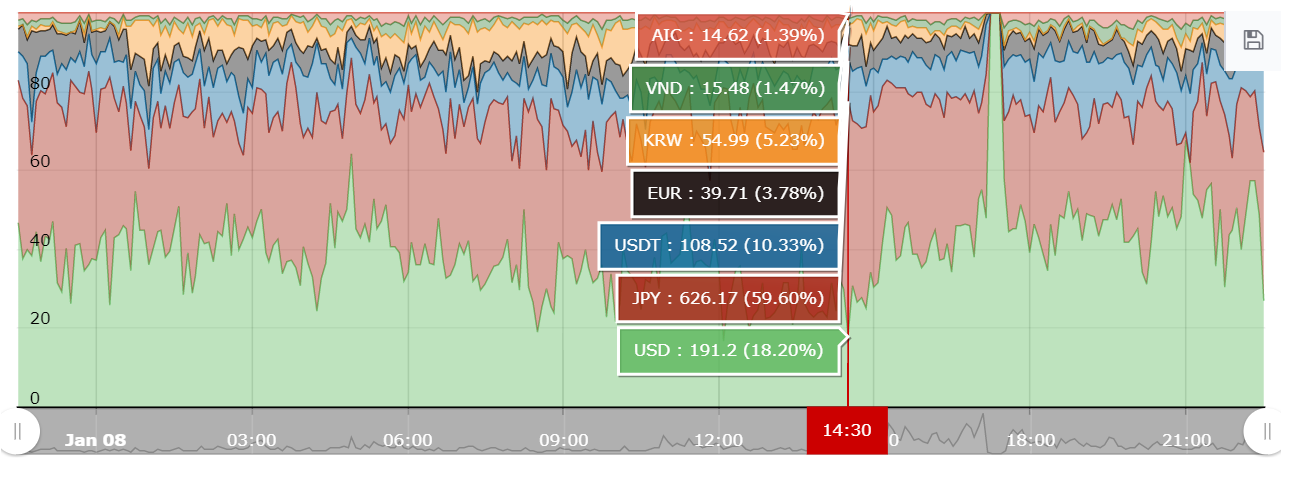

For example, I noticed an anomaly on Cryptocompare.com. From this graph, it appears as if the US Dollar controlled 100% Bitcoin volumes for a few minutes. This is of course highly improbable and is more likely due to imperfections in the data. They did tweet about some delays on their site at around that time and tried to reach out to them for comment but I guess they're probably pretty busy at the moment.

Ethereum As a Safe Haven

Over the last year and throughout the current crypto-boom Ether has stood out as the most solid blockchain network not just in price and "market cap" but in the number of transactions, transaction speed, the broad variety of use cases, and many other metrics.

But the biggest use case that has just been announced is not receiving nearly as much media coverage as it should.

It seems that the government of Brazil is about to use the Ethereum public blockchain to streamline their political process. Of course, we haven't heard any official announcement from the government as of yet but sources say that this is not only likely but necessary to restore confidence in the Brazilian Electoral Process.

We will of course keep our ears to the ground. Obviously, a nationwide government backed ERC20 token in the world's fifth most populated country could have a big impact on the network and on the infrastructure of global technology as we know it.

As always, please feel free to reach me directly through eToro or any other social network anytime with any questions, comments, feedback, and resources.

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.