The Institute of Supply Management released their manufacturing index today. As predicted in yesterdays posting on the Chicago ISM Business Barometer the ISM Manufacturing index came in below expectations (54.1 vs 54.5) with large builds in both inventory components. Outside of inventories there was not much going on in the most recent report with the notable exception of prices paid which jumped markedly in January. This will, of course, potentially affect profit margins in the months ahead. More importantly, and as discussed yesterday, the real question is whether or not we have seen the peak for this current economic cycle.

Internally it is always interesting see what the respondents are actually saying in regards to the their business and the economy as a whole to wit:

- "Still seeing raw materials pricing moving down in general, but expect inflation later in the quarter." (Chemical Products)

- "Year starting a little slow, but customers are positive about increased business in 2012." (Machinery)

- "Once again, business continues to be strong." (Paper Products)

- "Pricing remains in check with the demand we are seeing. Supplier deliveries are on time or early." (Food, Bev & Tobacco Products)

- "The economy seems to be slowly improving." (Fabricated Metal Products)

- "Business lost to offshore is coming back." (Computer & Electronic Products)

- "Business remains strong. Order intake is great — more than 20 percent above budget." (Primary Metals)

- "Indications are that 2012 business environment will improve over 2011." (Transportation Equipment)

- "Market conditions appear to be improving, with the outlook for 2012 better yet." (Wood Products)

These are all very positive comments on the overall state of the economy. However, the key take away here is that it is all based on past data. Things "seem" to be improving. "Indications" are better. Like consumer sentiment these are emotional responses to the past couple of quarters of improvement. Therefore, any negative drag in the coming months can quickly change these attitudes.

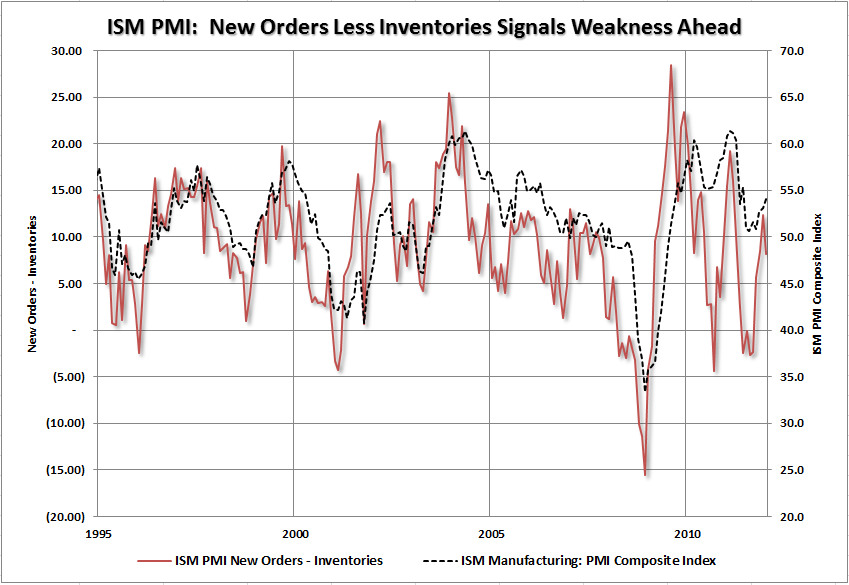

This is why it is critical, as investors, that we look beyond headlines for leading indicators that will help us navigate market related risk. One of those leading indicators has been New Orders less Inventories which has typically led the direction and overall condition of the ISM Manufacturing index. Currently, the recent turndown in that index, as inventories rose more (+4.0) than New Orders (+2.8), leads to concerns that we will see further weakness ahead for the ISM index.

Overall, the report was really a non-event and doesn't tell us much about the coming quarters ahead - just yet. However, with corporate profit margins already easing, the build up of inventories and rising pricing pressures are concerning. On Friday, we will see the Non-Manufacturing index and we can update our ISM composite index for a better view of the overall economy. Our "buy" signal remains intact and we will continue to recommend increasing risk based exposure on pullbacks that do not violate support. However, we need to keep an eye on the overall economy as the recovery is far weaker than normal, as even small shocks can have a big effect on equity prices and portfolios.