The mania of the markets that sees bad news celebrated and stocks rally as a result was in full effect yesterday following the US manufacturing ISM number disappointing the market massively. The measure fell into contractionary territory for the first time since November and alongside comments from the survey takers that manufacturing is unlikely to contribute positively to growth in Q2, saw USD fall precipitously.

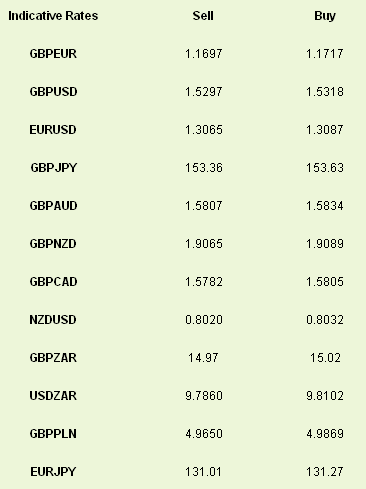

EURUSD and GBPUSD hit 3 week highs whilst USDJPY fell below 99 for the first time since finally breaking the 100 level. A rebound on the Nikkei this morning following 4 consecutive days of losses has seen the JPY weaken across the board through the Asian session.

The overall argument is how this affects the Fed’s ability to taper off its asset purchase plan. The reaction to a poor figure shows just how strong the fear is over a closing of the free-money spigot. The employment component of yesterday’s ISM number was poor with tomorrow’s ADP report the next jobs checkpoint before Friday’s payrolls announcement.

European PMIs yesterday were a lot better than expected with Spain’s hitting a 24-month high whilst Greece’s and Italy’s both broke recent records. Unfortunately, the readings remained in contractionary territory, so the recession is continuing but this will stoke hopes that a corner may be turned sooner rather than later. Euro rallied on the announcement as traders began to price out any movement by the ECB at their meeting this Thursday.

Leading the charge, however, was the UK, which posted a 14-month high. This combined with a revision to April’s figure showing a small amount of growth is heartening for those of us looking for strength in the UK’s SMEs. Whether this growth is as a result of an easing of weather conditions or an ability to take advantage of a weak pound through Q1 will remain to be seen but we suspect that both played a part. Chatter around a rebalancing of the UK economy need to continue, however, and should be front and centre for Messrs Osborne and Carney in the coming months.

The USD weakness yesterday allowed emerging market currencies that had been under the cosh in the past week to recover a tad. Despite a shooting at a palladium mine in South Africa, rand managed to battle back some of its losses whilst AUD and NZD also found buyers.

The Reserve Bank of Australia held rates overnight at 2.75% as had widely been expected but the attached statement remained particularly dovish and we foresee another rate cut within the next 2 months. Overnight tonight we receive the first reading of Q1 GDP from Australia and a disappointment there will likely bring the rate cut forward to next month’s meeting.

Following yesterday’s strong UK manufacturing number we are looking for another beat with today’s construction PMI due at 09.30. US trade balance is due at 13.30 BST with the market looking for a deficit of -$41.1bn.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

ISM Miss Lowers Near-Term Tapering Chances, Cracks USD

Published 06/04/2013, 06:44 AM

Updated 07/09/2023, 06:31 AM

ISM Miss Lowers Near-Term Tapering Chances, Cracks USD

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.