Welcome to 2012 and the first trading day of the new year. With it comes the release of the Institute of Supply Management (ISM) Manufacturing Index and the construction spending report. Both reports today showed modest improvements on the top line but do little to disuade the weak economic under tones that persist in this "struggle through" economy.

ISM Manufacturing Index

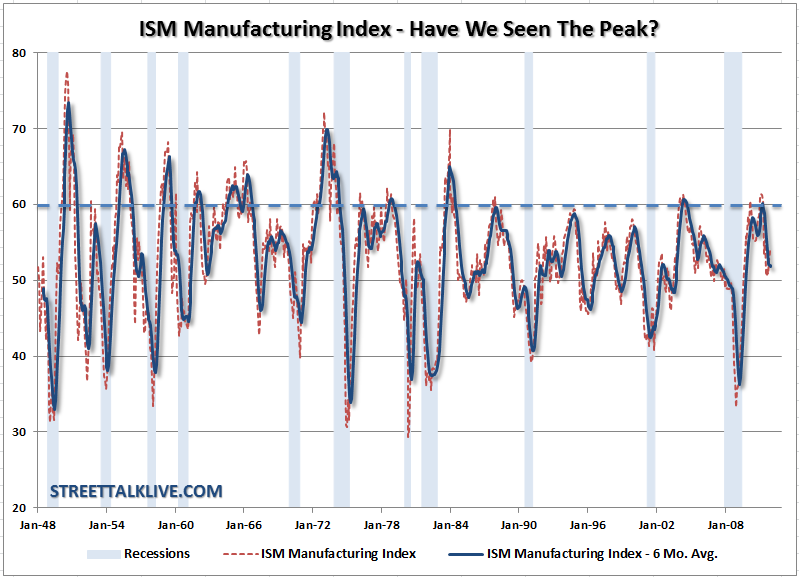

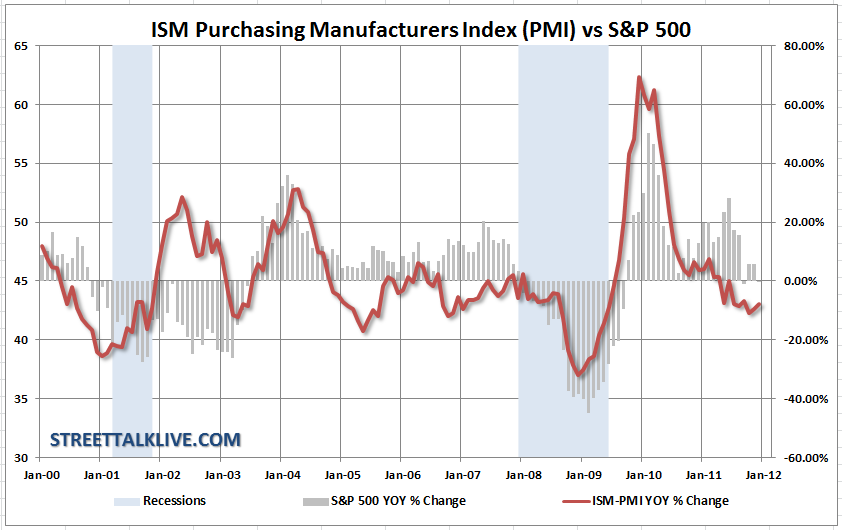

There was some continued strength in the manufacturing sector during December which currently keeps the U.S. on firmer footing than the European counterparts which have been in 5 months of decline. However, the index is still substantially below its April peak of 60.1. This leads to a couple of questions that we will explore. The first question is how much of the recent activity is just "catch up" from the combined effects of the Japan earthquake, which knocked out much of the auto industry this past spring, and debt ceiling debate and Eurozone crisis which halted the economy over the summer? This leads to the second question which is how long can the U.S. remain decoupled from Europe given that 20% of exports and profits come from that region?

The report did show some promising internals with New orders rising nearly one point to 57.6 as businesses restocked inventories. This increase in new orders led to a slowing of the draw on backlogs which points to stabilization in employment. There was also an acceleration in new export orders, which is a little bit of a "head scratcher" given the slow down in Europe and China, so it will be important to see if this increase is a just a bump or a sustainable trend - I highly suspect the former as the "catch up" period comes to an end. Other positive details included a strong rate for production, which explains the increase in employment, as well as continued easing in input price pressures.

On the surface the report reflected a more stable economic environment that what we witnessed this past summer, however, this is potentially just a reflection of adjustments made by manufacturers to get caught up after allowing inventories to be drawn down as concerns over the economy raged. On the whole manufacturers are sensitive to the current environment and respond accordingly, however, they then tend to forecast that current activity into the future.This is why, given the volatile nature of the economy during this past summer, that the extrapolation of that "catch up" could be a bit risky given the weak underbelly of the consumer.

This is reflected in the attitudes of the respondents:

- "Slow Q4 — lots of destocking and inventory reduction going on." (Chemical Products)

- "Business seems strong, but likely due to tax advantages of purchasing capital expense items." (Machinery)

- "Our business is stable with a very good outlook for 2012." (Miscellaneous Manufacturing)

- "Food prices seem to have peaked as demand is starting to wane." (Food, Beverage & Tobacco Products)

- "All auto demand remains strong." (Fabricated Metal Products)

- "Continued conservative hiring, with tight discretionary spending controls due to slower growth expectations for 2012, driven by Euro zone sovereign debt concerns and lack of viable U.S. legislative process through the 2012 election." (Computer & Electronic Products)

- "Business beginning to slow down (seasonal), but will finish with a very strong year." (Plastics & Rubber Products)

- "Business is steady today around the world." (Transportation Equipment)

- "Market has definitely slowed in the last month, and is expected to remain so this month." (Wood Products)

What is interesting to note is that the only two industries with positive contributions to the survey was transportation equipment and automobiles - the later of which has been buoyed by the restart post-Japan earthquake and the massive dealer channel stuffing to support production combined with sub-prime auto loans. (The last time we saw that combination was at the peak of the markets in 2007)

The point here is to be careful breathing too much optimism into today's report. The continuing trend is still negative despite recent bumps in the data. As investors what is criticial is being able to discern a bump from a change in trend and for that we simply do not have enough data to stand on.

Construction Spending

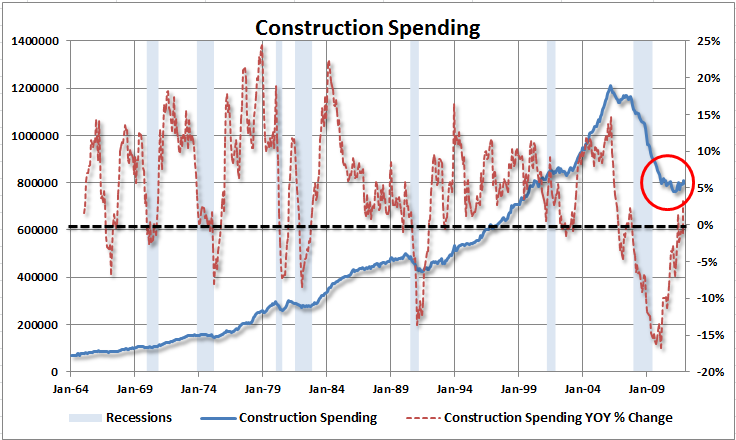

While the year over year change in construction spending has jumped sharply from its nadir in reality the strength of construction spending has changed very little from the recession lows. Activity did come in slightly stronger than expected as construction spending in November jumped 1.2% after slipping 0.2% in October (which was revised sharply downward from 0.8%).

The November increase was led by a 2.0 percent gain in private residential outlays, following a 2.3 percent boost in October. While single family construction did show some increase the real boost came in multifamily units as the demand for rentals has increased sharply with the continued stress of homeownership. On a year-ago basis, overall construction outlays improved to up 0.5% in November from a negative 0.6% in October.

Construction spending is a very important part of the economic recovery as construction has a huge multiplier effect through the economy for each dollar spent. However, in a normal economic recovery construction spending has usually been at new highs 30 months after the recession ended. Today, construction spending has barely ticked up 30 months post recession end in dollar terms and is years away from hitting new highs.

The current economic reports, while supportive of a "struggle though" economy provide little evidence of a strong economic recovery comin in the near term. This weakness will continue to plague corporations bottom lines which will suppress hiring and income growth. This leads to weaker consumption trends in the future which in turn impacts final aggregate demand. It is a vicious cycle of weakness that, like a cancer, will continue to drag on economic growth.