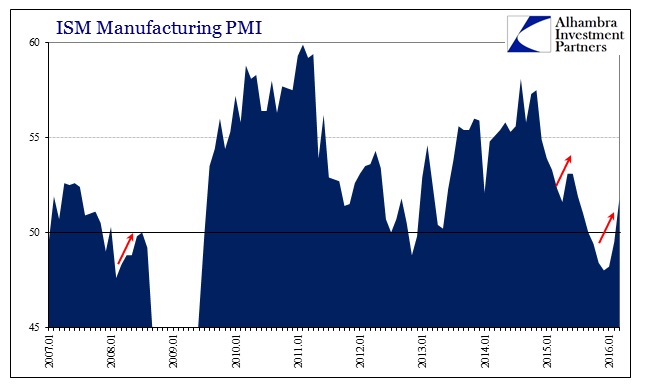

Everything I wrote in my last post on China’s PMI could be rewritten and reworded for the ISM version of American industry. The index rebounded to above 50 in March for the first time since last August. As noted with the Chinese PMIs, that doesn’t necessarily mean that growth has returned, only that March wasn’t likely as bad as January or February. Yet, every time there is a monthly rise or improvement, “it’s over” becomes the rallying cry. The boy doesn’t cry wolf, he cries recovery:

U.S. factory activity expanded in March for the first time since last summer, a sign the nation’s economy is shaking off the effects of a strong dollar and depressed oil prices…

“It seems like we’ve reached bottom in this business of oil prices and all other related prices as well,” said Bradley Holcomb, who oversees the ISM survey.

That was the same conclusion reached by the mainstream media last year at almost exactly the same point. Oil prices had then, as now, halted their crash, payroll reports suggested the same as they do now, and none of it made any difference – including the ISM PMI which rebounded to 52.8 (since revised up to 53.1) for last May and seemed to match the mainstream narrative of “transitory.”

The Institute for Supply Management’s factory index rose to a three-month high of 52.8 from 51.5 in April, figures Monday showed. The pickup in bookings and the strongest reading for order backlogs since November point to production gains that will probably help the U.S. economy’s bounce back.

The Bloomberg authors for the quote above at least had the good sense to qualify their assessment with “probably,” because oil prices and really the “dollar” didn’t last but for several more weeks past the story’s publish date. As the dollar went so, too, did the visible state of the global economy. Everything looks better when the world isn’t actively being liquidated by the (decaying) deep state of global finance, and that includes sentiment surveys such as PMIs.

I have little doubt that the rapid retracement in stocks and especially junk bond prices since February 11 played a full part of the shift in sentiment. To ask “will it last?” is really to wonder how much longer the dollar does in its current repose. With crude back under $37 again and other financial hints looming in that direction, it may not be that long before our answer.