There is not much to cheer the metals markets this year. Prices have broadly been in decline since the spring; and a wide – if not total –agreement that the commodities super-cycle has ended has dampened investors’ appetites for base metals as a commodity class.

It's Got Its Supporters

Zinc, however, has a growing band of supporters who view two developments as evidence that zinc prices have only one direction to go. The first is falling inventory on the London Metal Exchange, down from 1,212,575 tons on January 4 to 1,035,575 tons this week.

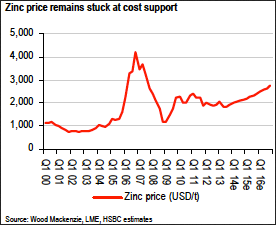

The second is the closure of major mines planned starting this year, coupled with a dearth of new projects after years of under-investment by an industry dissuaded by low prices. As a result, firms like Wood Mackenzie predict that zinc prices will average more than $3,500 a ton from 2016-18 – compared with just $1,940 so far this year. In the latest quarterly Global Metals & Mining Review, HSBC agrees, if not with the price prediction, then at least with the trend of rising prices over coming years.

On Demand

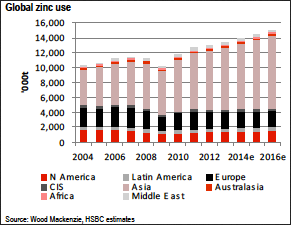

Certainly most agree demand will continue to rise. As HSBC points out, Chinese stimulus measures will be felt positively for several quarters and should therefore support demand in 2014. The stimulus is already evident, with Chinese apparent zinc consumption up 11% year on year to date in 2013, leading to a drawdown of SHFE exchange inventories and showing a 6% reduction in Q3 alone.

This has opened an arbitrage opportunity and has turned China into a substantial net importer of refined zinc. Year to date imports of refined zinc are 354,000 tons, up 17% y-o-y.

Even moderately rising demand will face falling supply by the middle of the decade, as some of the world’s largest mines reach their end of life. According to the FT, Brunswick and Perseverance in Canada, owned by Xstrata, closed this year. Late next year Vedanta is planning to close Lisheen in Ireland, which places among the dozen largest global mines. And in 2016 the world’s third-largest zinc mine, Century in Australia, is due to cease production.

The Mines

New mines have been few and far between. And as a result of the polymorphic nature of zinc resources, co-production of copper, lead and silver has kept many zinc mines running longer than expected, considering the low prices the metal earns. Hover, it has not been enough to encourage the massive investment new mines require.

So how can one offer caution against this bullish picture when faced with falling inventory, rising demand, and the imminent closure of major mines suggests we are in for a supply crunch?

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Is Zinc Set For A Bull Run?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.