Yield has been in a bear market for 38 years. Is that about to end?

The 10-Year Treasury yield has backed up from the Sept.-Oct. lows at 1.43% and 1.51% to a high at 1.97% last week. Is this a mere recovery "rally" in a still dominant 38-year bear market? Or is it a secondary low – i.e., double-bottom – 3+ years after the July 2016 historic low at 1.32%?

The answer is very important to investors in all asset classes because if yield merely is engaged in a recovery rally in a still dominant bear market, then we should expect longer-term rates to roll over again for another loop down into the mid-to-low 1% zone.

On the other hand, if yield is establishing a major July 2016 and Sept. 2019 double-bottom, then after 38 years a secular bull market in yield is in its infancy and the investment world as we know it will become a VERY different place.

Who knows what the path will be, but from my macro and technical market perspective, the markets are way overdue for a yield bull market – even if the fundamentals underpinning such a conclusion are at best difficult to imagine.

Questions

Then again, suppose a very progressive candidate emerges as the Democratic nominee (Warren, Sanders?) or even someone who is less progressive but who is all about redressing income inequality via fiscal policy prescriptions. Anticipating a close presidential contest in any case, the mere nomination of a Democratic candidate who pounds the idea of redressing income inequality in and of itself could drive interest rates higher.

Add to that, potential impeachment hurdles to President Trump's runway to 2020 and just maybe we have a strange brew that causes bond investors angst, which drives rates higher.

And then there is the third-rail issue of debt and deficit spending that no politician wants to go near. Why? Haven’t you heard, deficits don’t matter anymore, or so says the MMT aficionados (proponents of Modern Monetary Theory, Helicopter Money, Universal Basic Healthcare, et al), who advocate running the printing presses 24/7 to redress income inequality. Does anyone think rates will remain quiescent under such circumstances, or in anticipation of a 2020 outcome that will adopt such fiscal polity prescriptions?

It is much more natural to consider the recent backup in yield as a bounce in a bear market prior to another roll over in yield. All as the 10 year post-Financial Crisis economic "expansion" runs out of gas, employment softens a bit and unemployment upticks, which negatively impacts consumer confidence, subduing retail sales despite a Fed that continues to pump an ocean of liquidity into the banking system.

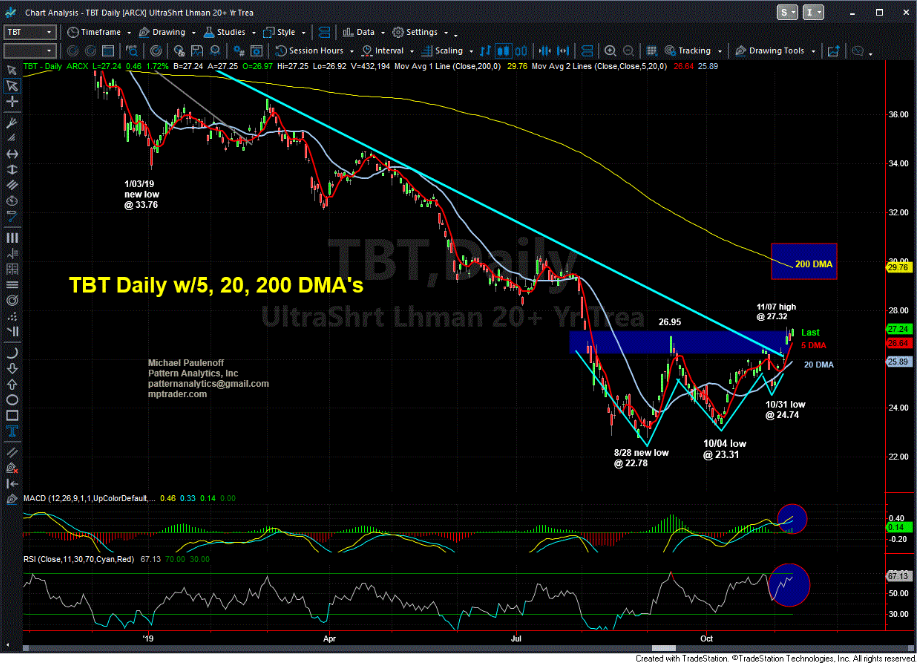

After consideration of the factors mentioned above (among countless others I haven't noted) if I proceed on the basis of my technical work ONLY, I would have to err on the side of higher rates, meaning that the formation of a 2016-2019 major Double Bottom in 10-Year yield is the determining consideration in taking a directional position LONG TBT's in the hours or days directly ahead.