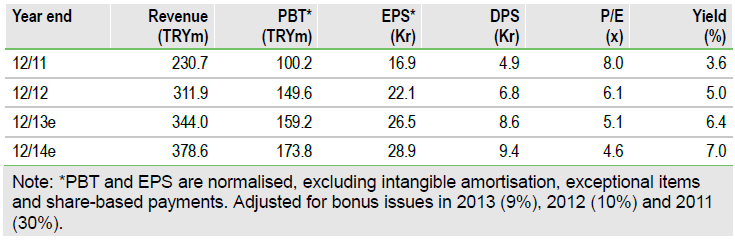

IS Yatirim’s (ISY) investment banking division reported a 33% fall in operating profits during H113 as narrower spreads on interest rates reduced profits earned from interest and trading. Including the volatile profits from subsidiaries, consolidated profits were 52% lower. Substantial gains have already been generated since mid-year, which should see a recovery in subsidiary profits in H2. We have kept our long-term growth assumptions unchanged but reduced our FY14e fair value estimate by 20% to TRY1.9, reflecting the recent macroeconomic trends in Turkey.

H1 profits down but expected to recover in H2

Lower interest and trading income contributed to the 9% drop in revenues. Profits fell more (33%) because costs increased 5% as ISY continues to invest in the business to grow market share. Lower contributions from subsidiaries led to a 52% decline in consolidated profits. Although consolidated H1 revenues of TRY138.9m were 11% below our estimates, we have kept our forecasts unchanged as H2 profits will benefit from the sale of Aras Kargo by IS Private Equity. This sale was completed in July and will add TRY24m to ISY’s net profits after minorities.

Economic and political risks remain high

Turkey has been bearing the brunt of the selloff in emerging markets over the past three months (-25% vs MSCI EM Index: -10%) as concerns have been raised over the possible reduction in quantitative easing measures in the US, slowing economic growth in Turkey and a resurgence in domestic and regional political risks.

New regulation driving consolidation

Turkey’s investment banking sector is undergoing a similar level of consolidation to that previously seen in Europe. There are currently around 100 brokers operating in Turkey, but CMB expects this to fall to c 35 leading up to the introduction of new regulatory capital requirements in July 2014. With its robust capital position (FY12 equity: TRY465m), ISY is in a very strong position to capitalise on this sector consolidation and to increase market share even further.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

IS Yatirim Menkul Degerler

Profits expected to recover in H2

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.