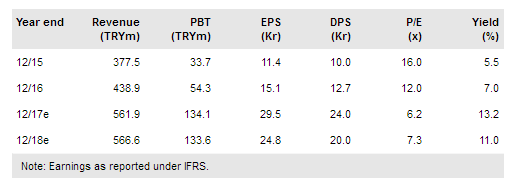

Is Yatirim Ortakligi AS (IS:ISYAT) produced a very strong result in H117 against the backdrop of an improved political and economic environment in Turkey, which has seen a strong improvement across capital markets. With the benefit of leading market positions, ISY has seen revenues increase across all product areas with particular strength in interest and trading. Meanwhile, costs have been kept under tight control and below the level of inflation, which is running in excess of 9% pa. We have significantly increased our forecasts for the current year, while prudently making little change to FY18 given the inherently uncertain nature of capital markets.

Investment banking driving increased forecasts

H117 consolidated net income, including subsidiaries and after minority interests, more than doubled compared with H116 (+169% from TRY26.2m to TRY70.6m) and was also up significantly on the TRY27.7m reported in H216. The main driver was Is Investment, the core investment bank which, excluding foreign and domestic subsidiaries saw an 86% increase in net income from TRY48.4m to TRY90.1m. Group revenues grew 40% y-o-y with interest and trading income up 60%, while costs grew 5% (cost-income ratio 61% vs 81% in H116). These trends were particularly evident at Is Investment with revenue growth of 48%, cost growth of 3% and the cost-income ratio falling to 55% (from 79%).

To read the entire report Please click on the pdf File Below: