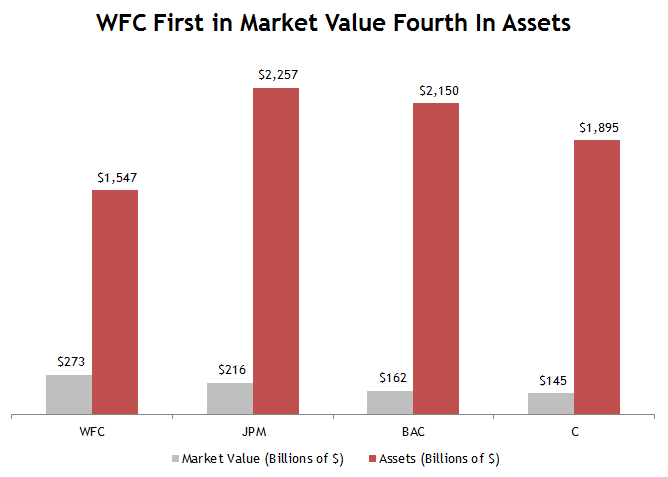

Monday’s Wall Street Journal noted that Wells Fargo & Company (NYSE:WFC) is only $10 B in market cap away from becoming the most valuable bank ever. WFC’s current market value exceeds J P Morgan Chase & Co (NYSE:JPM) by $57 billion and is nearly twice as valuable as Citigroup Inc. (NYSE:C).

Assets paint A Different Picture

It’s amazing that Wells Fargo has been able to climb to the top of the banking pile, because from a balance-sheet perspective, WFC is actually the smallest of the big four U.S. banks. Banks drive revenue from their asset base and WFC would have to grow its assets by 45% to catch JP Morgan, 39% to reach Bank of America Corporation (NYSE:BAC) and 22% to reach Citigroup.

This is not to say that Wells Fargo is overvalued, because Wells is only trading at 13x trailing earnings. Wells is more profitable than its peers, and the relative market values say more about Wells’ peers than Wells. BAC, JPM and C are severely under-earning their potential largely because they continue to deal with legacy issues. From a revenue perspective, BAC and JPM each generated more revenue than Wells did in 2013.

The banking system got much more concentrated as a result of the financial crisis, so it’s not surprising that one of these banks is approaching the largest market value ever. What’s surprising is that the other ones haven’t gotten there first.