While price action is my main focus, understanding how volume plays a role in the market can be key in understanding the environment and health of a market cycle. We often use market internal indicators, such as the Advance-Decline Line to gauge whether the bulls or the bears are “in control” based on the what’s taking place below the surface of the financial markets. Volume can also serve as a good tool in understanding what’s driving a market higher or lower, and what’s taking place in the current U.S. equity market has me concerned.

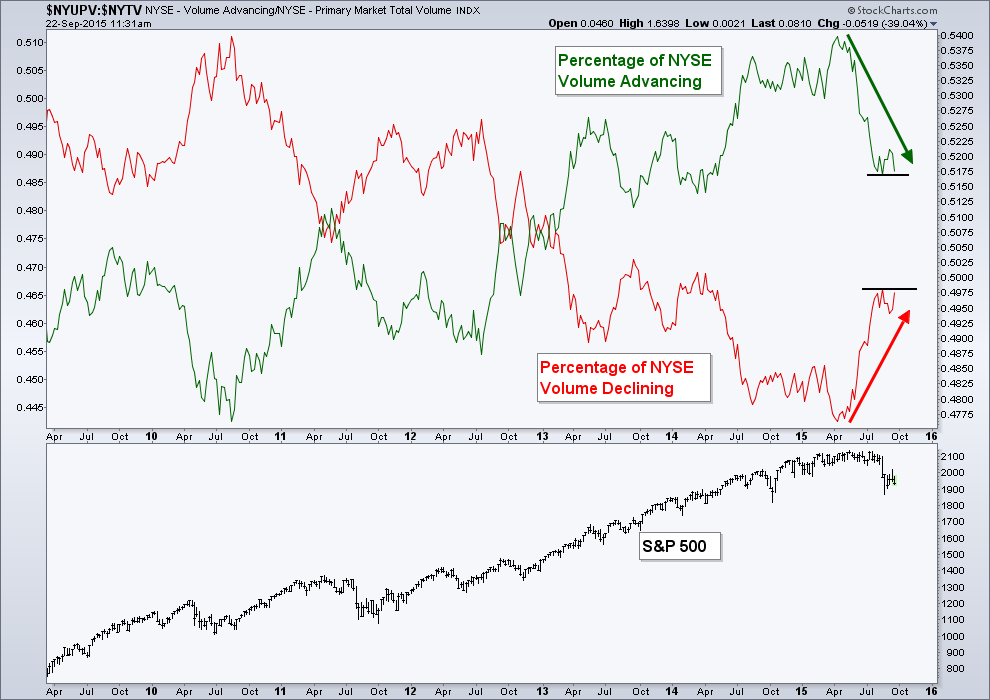

The New York Stock Exchange is not a ‘pure’ equity market, having some bond-type funds and other assets also trading on the exchange. However, it’s still one of the best and largest proxies for U.S. markets. By analyzing advancing and declining volume, just like we do with the Advance-Decline Line for price, we can measure the health of a trend. This is what the chart below shows… the percentage of volume that’s either Advancing or Declining. I’ve applied a long-term moving average to each data set to smooth out the whipsawing gyrations and better see the buying and selling pressure taking place.

The chart below shows the time period from late 2009 to current on a weekly basis. We can see that the red line, which represents the moving average of the percentage of NYSE volume that is declining is making a series of lower highs while the percentage of NYSE volume that is advancing, as represented by the green line, is making higher highs. This is a good sign of a healthy bull market. These two trends tell us that there’s a positive environment of a steady increase in the share of volume trading that’s being picked up by equity bulls.

However, since the start of this year the trends have begun to shift. We’ve seen a fairly quick move in both sets of data as they change direction. The percentage of NYSE volume that is declining has been rising, and is close to putting in a higher high, with the advancing volume doing the opposite – nearing a lower low. Both data sets have already broken past their prior lows (green line) and highs (red line) set at the start of the year. This type of shift often precedes dominate changes in equity trends, which is why this chart has increased in importance in my view.

It’s been said that volume leads price and if that’s currently the case then it’s possible we see U.S. equity prices see a change in its bull market status.

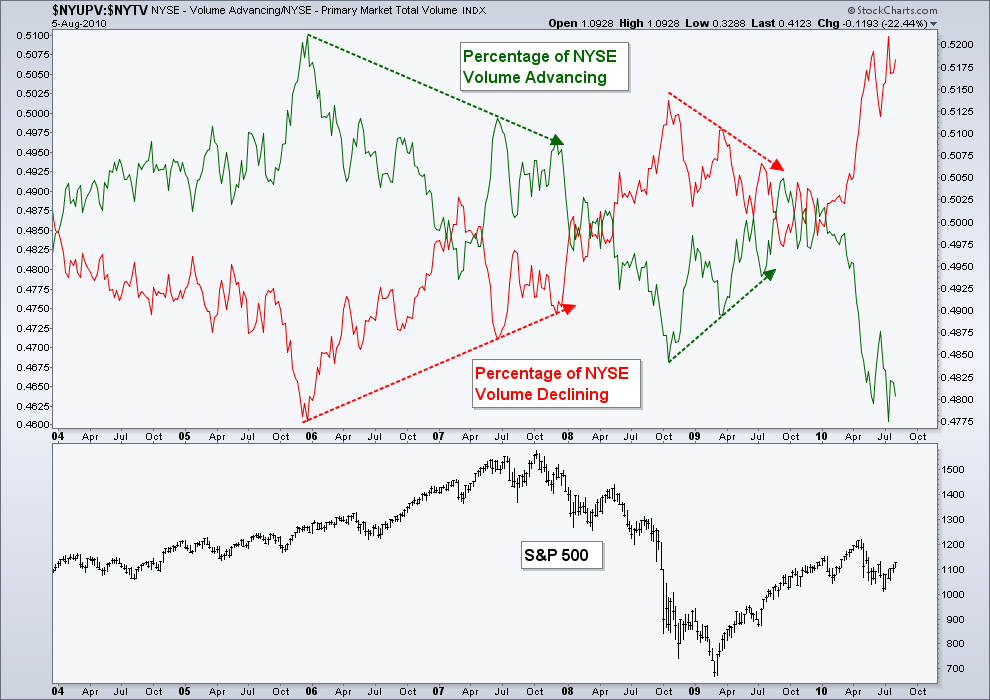

To put the above chart in better context, let me show an example from 2007-2009 bear market. I don’t show the financial crisis time period as an analogue for what I think the current market will result in, but just as the most recent example of a shift in volume that’s taken place.

Below is a weekly chart from 2004 through 2010. Starting in 2006 we began to see a trend change in both volume that was advancing and volume that was declining as a percentage of total NYSE volume. It took over a year for the shift in volume to begin to be reflected in price, a good reminder that if the change that may be taking place currently is correct it doesn’t necessarily mean price will turn on a dime and head lower.

Also notice the trend changes in volume before the 2009 low. Starting in October of 2008 a series of higher lows (for volume advancing) and lower highs (for volume declining) began to take place – signaling a shift in market buying and selling pressure.

Pairing this type of volume analysis with the long-term trend and moving average breaks that’s taken place in major U.S. indices, and the deterioration in other market breadth indicators is concerning. At the end of the day, price is what’s important and is what we must keep our focus on. Storm clouds may be setting in, but we don’t begin to use umbrellas until it starts to rain.

Disclaimer: Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this post is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in the blog. Please see my Disclosure page for full disclaimer.