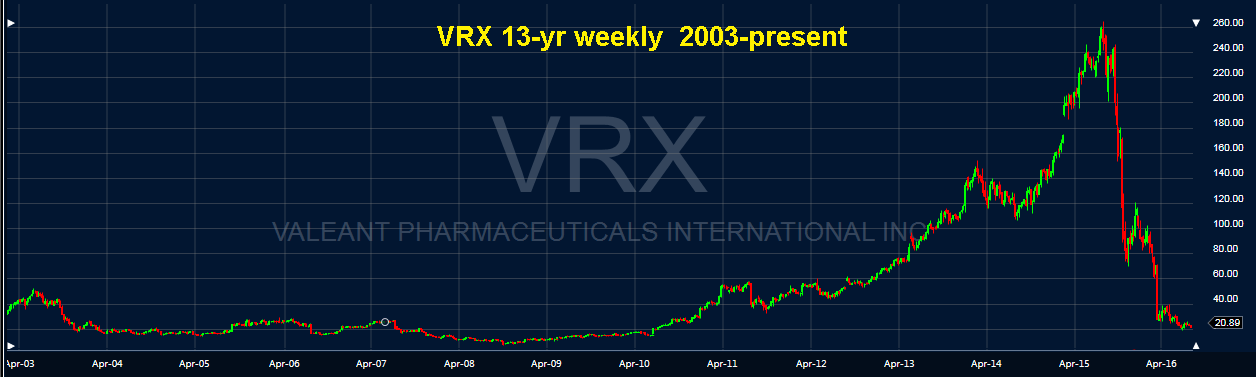

Earlier this year in March, Valeant Pharmaceuticals (NYSE:VRX) stock plunged in one day from $70 to $36. I had not paid much attention to the VRX saga until then. When I examined the financials I was quite aghast with what looked to be the potential for another Enron.

The financials are riddled with multiple accounting improprieties, if not outright fraud. The balance sheet sports over $31 billion in debt against just $9 billion in tangible assets. It’s tangible net worth is negative $32.6 billion.

I stopped following the Valeant saga once Bill Ackman made a lot of noise announcing a new CEO and board. I figured the stock would bob and weave before and after every press release Ackman crafted to generate interest in the stock. Early April was my last commentary on the stock, although I’ve considered featuring it my Short Seller’s Journal as a great short idea.

But today, VRX stock caught my attention because it dropped over 6% on heavy volume for no apparent reason. Upon closer inspection, it looks like VRX may be in danger of violating its debt covenants this year.

VRX appears to be in an irreversible debt spiral. Valeant’s current credit rating from Moody’s is B2. VRX’s ratings have been on a downward path for several years. Typically this is an irreversible path that eventually leads to bankruptcy of some kind or a pre-pack debt restructuring.

I was fooling around with graphs earlier and noticed an absolutely stunning similarity between Enron’s stock and Valeant’s stock.

Where there’s smoke in the stock market, there’s usually fire. At some point I would bet – in fact I am betting with puts – that VRX shareholders are going to get doused with napalm…But hey, stock and bond investors should be grateful. Moody’s had Enron rated triple-A until just before it filed for bankruptcy. At least with VRX, Moody’s has been gracious enough to give investors a “heads up.”