Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

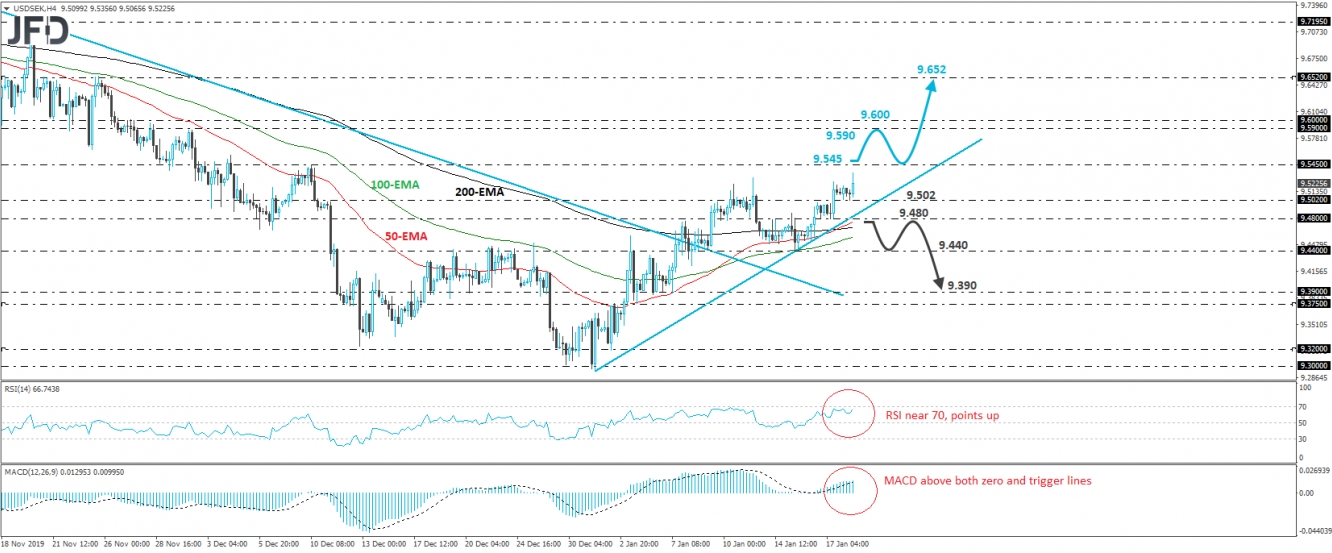

After oscillating slightly above the 9.502 barrier during the Asian session today, USD/SEK rebounded somewhat. Overall, the rate is trading above a prior downside resistance line drawn from the high of October 9th, as well as above a new upside one, taken from the low of December 31st. Therefore, we would consider the short-term outlook to be positive for now.

Nonetheless, we would like to see a clear break above 9.545, marked by the high of December 10th, before we get confident on larger upside extensions. Such a break could allow the bulls to drive the battle towards the 9.590 hurdle, defined as a resistance by the peak of December 2nd. That said, for more upside, we would wait for a move above 9.600. This could set the stage for the 9.652, which provided resistance on November 21st and 25th.

Taking a look at our short-term oscillators, we see that the RSI stands near 70 and points up, while the MACD lies above both its zero and trigger lines, pointing north as well. Both indicators detect upside speed and support the notion for more upside extensions in this exchange rate.

On the downside, a dip below 9.480 may signal that the bulls have left the building, leaving room for the bears to drive the battle lower. Such a dip may also confirm the break below the upside line taken from the low of December 31st and may initially open the path toward the low of January 15th, at around 9.440. Another break, below 9.440, could carry larger bearish implications, perhaps towards the 9.390 zone, which supported the pair on January 6th and 7th.